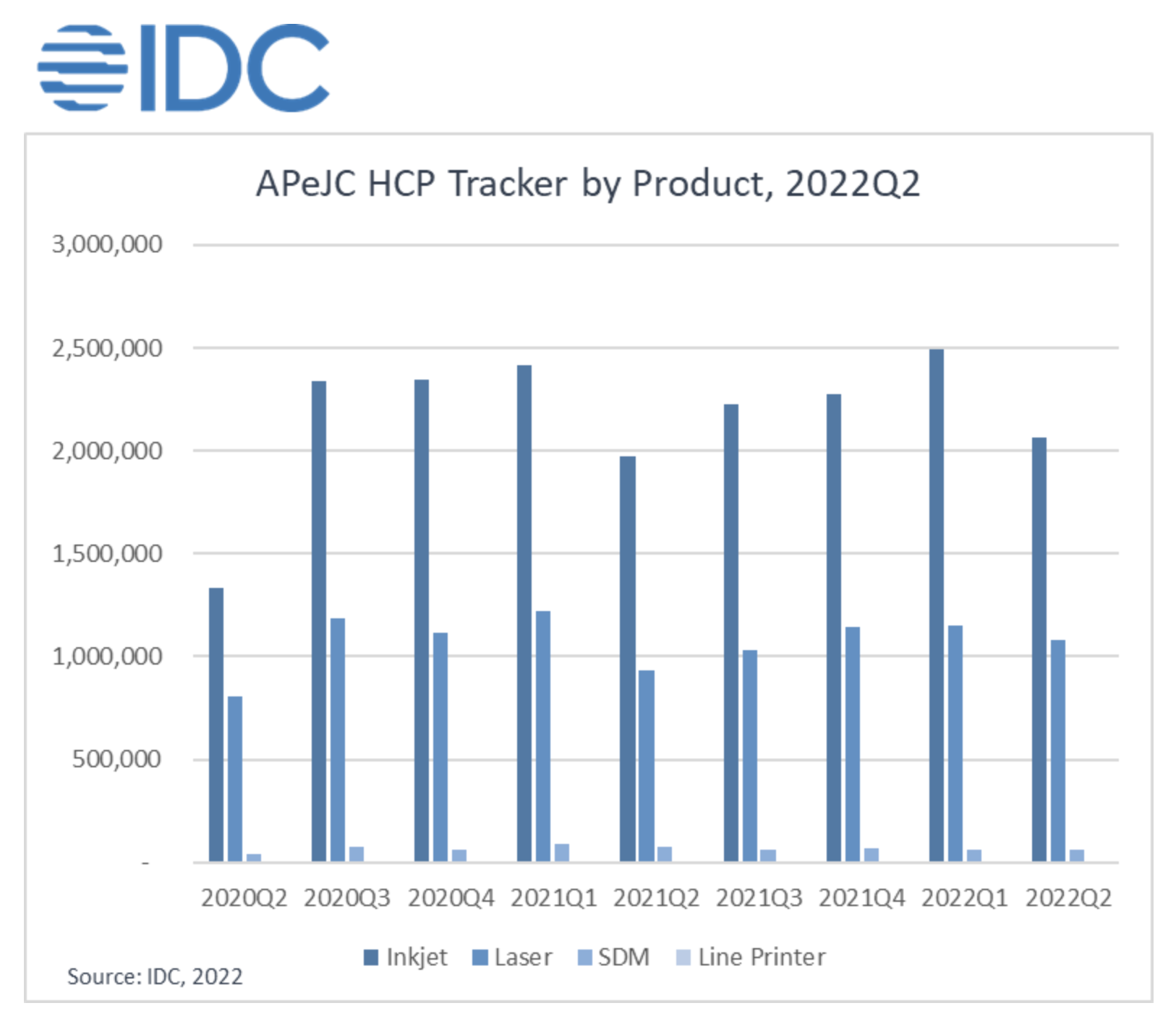

Asia/Pacific’s excluding Japan and China (APeJC) hardcopy peripherals market sees 3.21 million units shipped in 2Q2022, a 7.6% YoY growth, IDC finds.

According to the IDC Worldwide Quarterly Hardcopy Peripherals Tracker, the Hardcopy Peripherals (HCP) market in Asia/Pacific excluding Japan and China (APeJC) recorded 3.21 million units shipped in the second quarter of 2022, a 7.6% growth from 2.98 million units a year ago. Despite total shipments being lower than the past three quarters, this marked the region’s first growth quarter after three consecutive preceding quarters that registered year-over-year (YoY) declines.

Among the products in HCP, inkjet and laser contributed to the region’s growth, while SDM and line printers reported double-digit YoY declines. The inkjet market in APeJC achieved growth in both ink cartridge and ink tank segments, driven by economic recovery and improvements in supply chain challenges compared to the same period last year. However, the inkjet market declined sequentially with a slowdown in overall demand from the consumer segment since the full reopening of almost all schools and workplaces.

IDC added that consumers were also observed to be more conservative in spending due to the impact of inflation. The laser market saw the highest YoY growth in A4 mono laser (20.8%), thanks to better supply recovery that also led to vendors taking this opportunity to participate in government and enterprise tenders. Sequentially from Q1, laser declined lesser than inkjet as the printing requirement in the commercial segment was still relatively higher.

“Very few countries recorded sequential growth in inkjet printer shipments this quarter, as most countries experienced a decline following reduced consumer spending compared to the first quarter. Laser market’s top performing countries also experienced stronger rebounds YoY compared to inkjet market, against the backdrop of strict lockdown measures last year which have now been lifted,” said Yi Karl Tai, Market Analyst at IDC Asia Pacific.

India, the largest inkjet market in the region, witnessed a demand drop from the home segment as summer vacation started. Small and medium businesses (SMBs) had a similar demand trend in Q2 as in Q1. Along with India, Indonesia and Korea were the two other countries that also contributed to inkjet’s YoY growth.

Vietnam, which ranked after India and Korea in terms of laser market size, had the largest YoY growth in laser. This was attributed to the severe lockdown restrictions back in the base period of 2021Q2, which hampered production and logistics arrangements. Korea observed both YoY and sequential growth as supply saw improvement after a few quarters of consecutive declines.

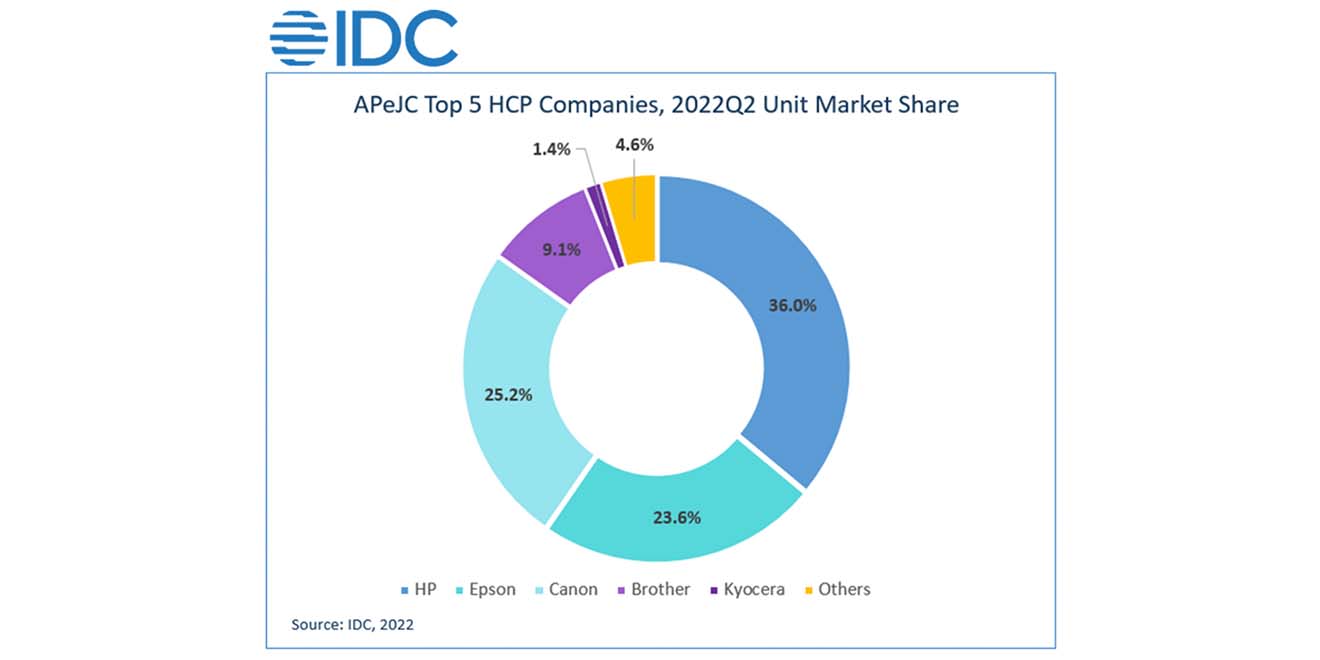

HP secured its position as market leader with market share of 36.0%. In this quarter, HP managed to overtake Canon as the top HCP vendor for Singapore. HP recorded a high YoY growth of 20.1% but declined by 9.6% sequentially. HP’s inkjet portion grew by 21.7% and laser portion grew by 18.3% YoY mainly due to the recovery in supply shortage and production when compared to 2021Q2. It was observed that HP experienced a QoQ decline because of slowdown in demand from home user segment which caused HP’s inkjet shipment to decline, laser portion declined due to high allocation base in the previous quarter.

HP secured its position as market leader with market share of 36.0%. In this quarter, HP managed to overtake Canon as the top HCP vendor for Singapore. HP recorded a high YoY growth of 20.1% but declined by 9.6% sequentially. HP’s inkjet portion grew by 21.7% and laser portion grew by 18.3% YoY mainly due to the recovery in supply shortage and production when compared to 2021Q2. It was observed that HP experienced a QoQ decline because of slowdown in demand from home user segment which caused HP’s inkjet shipment to decline, laser portion declined due to high allocation base in the previous quarter.

Canon took second place this quarter with 25.2% of the total market share. Canon also recorded a high YoY growth of 19.0% but declined by 14.6% on a quarter-over-quarter basis. Canon faced similar market trend as HP, observed a sequential decline of 19.6% for its inkjet products due to the shift in consumer demand. Unlike inkjet, Canon’s laser segment only experienced a minor decline of 1.0%. Although few of the copier-based and printer-based models were having supply constraints, the overall supply condition saw gradual improvement.

Epson fell to third place with a market share of 23.6%, but remained as the top performing brand for Indonesia, Philippines, and Taiwan. In comparison to Canon and HP, Epson was severely impacted by supply chain and production hiccups in many of countries of the region. Epson’s shipment for this quarter was the lowest since 2021 and recorded a YoY decline of 16.5% and QoQ decline of 22.5%. Both supply condition and market demand in this quarter were not favourable for Epson.

“We are expecting supply chain and production setbacks in APeJC to have a higher recovery in the coming months, though the overall market shipments would be moderated by the impact of global inflation and the slowdown in home user demand for inkjet. This may be compensated by the commercial segment, where we observed a trend of SMBs in the region shifting their preference from laser towards ink tank,” said Sok Yan Leong, Market Analyst at IDC Asia Pacific.