IDC India has revealed that the country has witnessed a 17.5 percent decline in the printer market across 50 major cities for Q4 2017.

This decline was reported in IDC’s most recent India Monthly City-Level A4 printer Tracker, and follows on from a “momentous” Q3. The tracker also revealed that inkjet printers were the strongest in the market, leading with a 52.2 percent share, while in terms of sales, Delhi, Mumbai and Chennai were the “top three cities” and Pune, Vadodara and Bangalore represented “major growth markets” for Q4.

The printer market decline was attributed to “mitigation of post GST impact”, vendors and channel partners managed to drive sales “through channel schemes and end user promotions across major markets along with regular channel expansion program.”

Abhishek Mukherjee, Senior Market Analyst at IDC India, explained, “Low cost of ownership and printing compared to Laser printers account for the increasing uptake of Inkjet printer category.”

CISS ink tank printers were the market dominators within the inkjet category, with Tier 3 and 4 cities driving 50 percent of their sales volume.

“Wide reach and depth of the distribution network are the key to catering to the demand coming from Tier 3 and 4 cities. Almost all the brands have increased channel presence in smaller cities to fulfil the demand,” added Mukherjee.

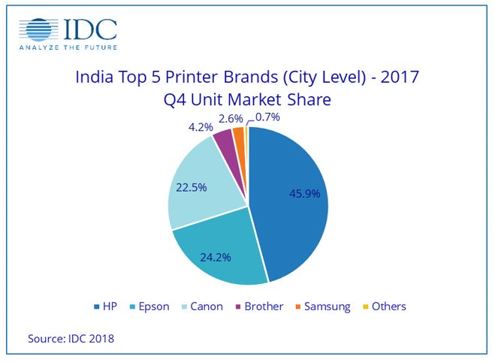

In terms of vendors, HP Inc “maintained overall leadership in A4 printer market with 45.9 percent market share in 50 cities across India”, focusing on sales of entry level laser printers.

Epson took the top spot in the Inkjet Printer Market, with a 46.3 percent market share, while Canon “secured 3rd spot in overall A4 printer market with 22.5 percent market share in 2017 Q4.”

“With Canon expanding its CISS portfolio and Epson also launching new printer models in January, CISS share in Inkjet printers will continue to grow with major contribution coming from Tier 3 and 4 cities. In the A4 laser category, 21-30 ppm printers are gaining traction over 1-20 ppm printers which have dominated the market historically. Strong demand of the higher speed printers is likely to continue with major contribution coming from West Zone,” said Nishant Bansal, Research Manager, IDC India.