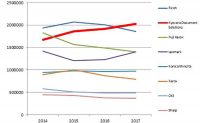

IDC data showing Kyocera’s rise.

The Chinese company has published a new blog on the OEM, which it describes as “one brand that is worthy of attention.”

Ninestar states data from IDC, which reports shipments of more than 2 million Kyocera machines in 2017, which makes it the fourth biggest vendor, only beaten by Canon (HP), Brother and Samsung. This represents a 20 percent increase in shipments, and also saw the OEM overtake Ricoh.

Kyocera’s product layout is another reasoning that Ninestar gives for its highlighting, with the Ninestar blog reporting that the OEM “released more than 40 new machines from the end of 2016 to 2017,” and that up to the end of Q2 2018, “the installed base of the new machines is about 1.3 million units.” More than 30 new machines have been released by Kyocera this year, and at least 29 further new machines are expected next year, including the TASKalfa 9600, 11100, and 1360 production printers, a new direction for the OEM. “Obviously, Kyocera is not only steadily expanding its original product line, but also actively exploring the new market,” Ninestar contends.

Kyocera is also described as a “big player” in the MPS industry, which means that for Ninestar distributors, “it’s a good way to penetrate high-end channels by paying more attention to Kyocera products and selling Kyocera products.”

The blog also praises the OEM’s ECOSYS technology, which it claims “brings lower cost and more competitive products,” as its “core technique” is a-si OPC, replacing the traditional OPC; with a surface hardness “30 to 50 times higher than that of the OPC in the traditional drum unit,” Kyocera’s ECOSYS technology “is more durable,” and so the cost per page is decreasing. “Hence, Kyocera maintains a cost advantage to their competitors in marketing activities.”

Ninestar also claims that “Kyocera’s innovative technology increases the thresholds for compatible products,” as the OEM’s latest products in the Russian market feature “Gradual Cavity Compression” technology, which constantly compresses the cavity of the toner hopper throughout the printing process, meaning that “gradually, there is less and less cavity/space for customers to refill the toner.”

The blog ends with a rundown of how Ninestar is responding to Kyocera’s market potential, stating that the company “has invested huge resources in developing replacement consumables for Kyocera product lines.”

Advantages offered by Ninestar include: Availability “for the whole line of Kyocera products”; “imported quality toner”; “quick and reasonable chip support” from its brother company, Apex; specific compatibility testing, “to ensure that our products are compatible with OEM products and will not do harm to customers’ machines”, and to ensure that they are “compatible with customers’ last purchased products.”

To read the blog in full, click here.