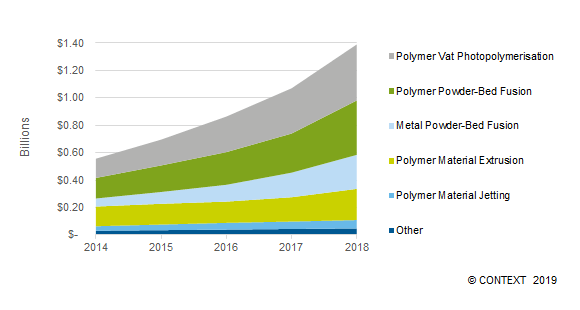

Chart 1- Five-year global Industrial:Professional materials utilisation revenues by material and process

According to the new research update by CONTEXT, the 3D-printing industry sees a 26 percent CAGR materials revenue growth as annuity streams shift to manufacturing.

Revenues from materials for Industrial/Professional 3D printers have surged by $4.6 billion (€4.08 billion) over the past five years with 29.9 percent year-on-year growth in 2018 alone, according to new research from CONTEXT. The market looks set to better the 2013–2018 five-year CAGR of 25.98 percent and is on track to amass another $15 billion (€13.32 billion) in the next five years.

Although still a small part of the $12 trillion (€10.6 trillion) manufacturing industry, the market for materials for use in 3D printing, also known as additive manufacturing (AM), has grown strongly as the number of 3D printers installed has expanded.

From 2014 to 2018, 80.6 percent of global revenues for materials used in Industrial/Professional 3D printers came from polymers (plastics), while metals accounted for 13.5 percent. However, the latter’s share grew to 17.9 percent in 2018 while polymers’ dipped to 78.8 percent, highlighting the growing momentum of metal-based AM.

The AM market, like the larger general manufacturing market, is made up of sub-markets that are often aligned with unique technologies and material properties. New research, based on comprehensive and detailed analysis of what professional AM machines are used for, reveals very different core usage of materials across machine types, CONTEXT explained.

The outdated idea that 3D printing is still predominantly used for prototyping is based around polymer extrusion (FDM) machines. While this technology is often the most visible, and in many people’s minds accounts for the entire market, revenue from materials for these machines was behind that from materials for resin vat photopolymerisation and polymer powder-bed fusion machines during 2014–18.

Although most material extrusion machines are still used predominantly for prototyping, other core polymer 3D-printing technologies, such as vat photopolymerisation (commonly known as SLA, DLP or DLS/CLIP) and powder-bed fusion (including traditional selective-laser sintering – SLS – and HP’s MJF), are being increasingly used for low- and mid-volume production as well as for mass customisation.

CONTEXT’s new report examines the 3D-printing materials market to reveal quarter-by-quarter utilisation of materials by machine type, process, core-material, sub-material end-market, and principal use, allowing users to examine the entire global market as well as individual processes and end markets.

The report breaks major material types for each process into key subgroups. For polymer extrusion these are ABS, ASA, FDM nylon, PLA, ULTEM; for vat photopolymerisation they are casting resin, dental resin and professional resin; and for powder-bed fusion the groupings cover materials such as PA11, PA12, PA–glass beads, PEEK, and PEKK. For AM with metals, sub-materials include aluminium, cobalt -chrome, nickel alloys, precious metals, steels and titanium; and the usage of other materials – wax, ceramics, sand, biological materials, and many more, is also examined.