Asia/Pacific hardcopy peripherals market hits record low with 15.2% YoY drop in 3Q23, but is expected to rebound in Q4, IDC says.

In a striking downturn, the HCP market in the Asia/Pacific excluding Japan region (APeJ) dropped 15.2% year-on-year (YoY), according to the IDC Worldwide Quarterly Hardcopy Peripherals Tracker.

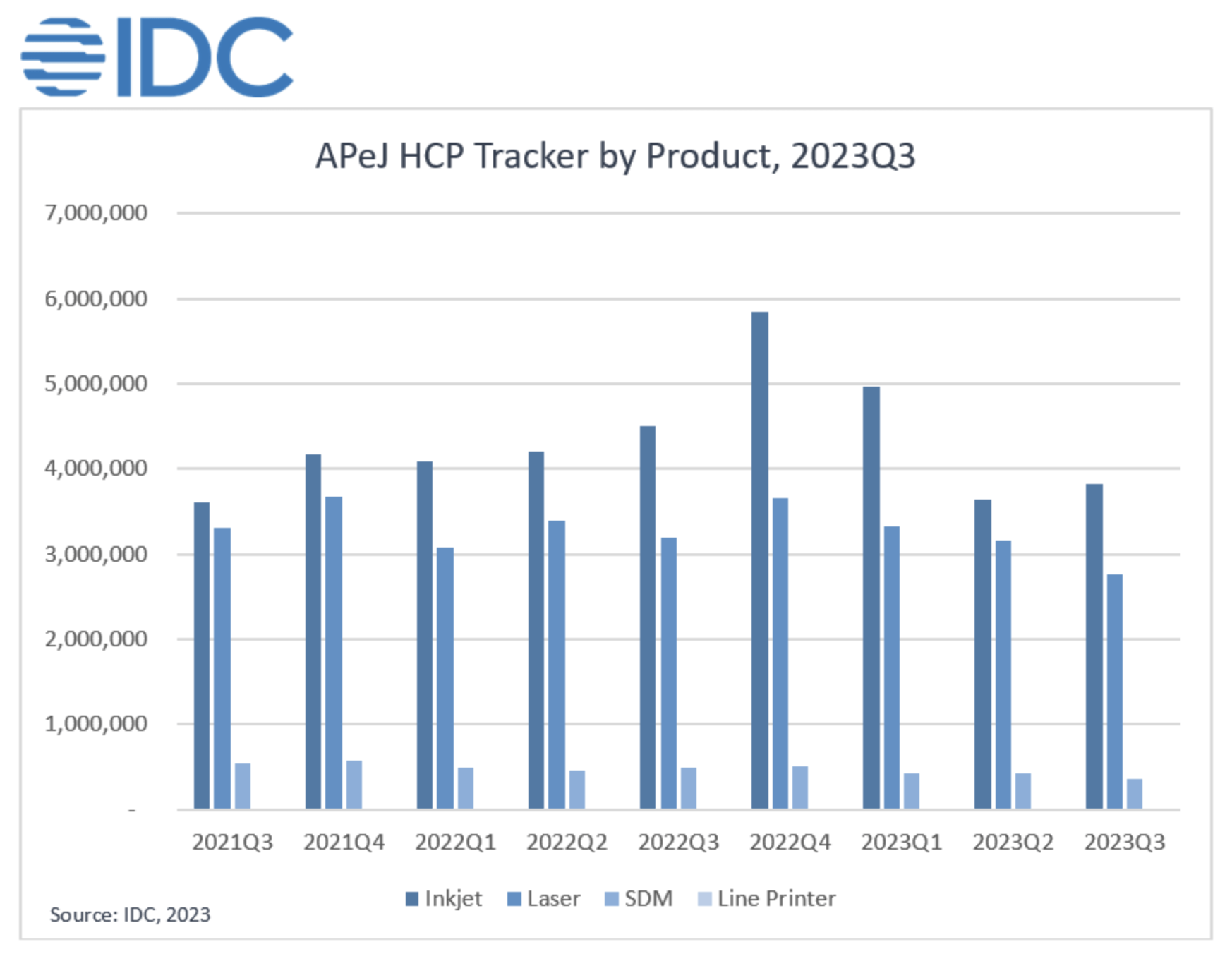

The HCP market in the region registered 6.9 million units shipped in 3Q23 – the lowest shipment recorded in the post-pandemic period. The total HCP market across multiple countries remained pressured by macroeconomic factors which weakened the demand for both consumer and commercial segments. Breaking down the YoY performance of each product type: total Inkjet portion declined by 15.1%; Laser devices, including A4 and A3 machines, declined by 13.5%; and Serial Dot Matrix (SDM) segment declined by 26.4%.

The HCP market in the region registered 6.9 million units shipped in 3Q23 – the lowest shipment recorded in the post-pandemic period. The total HCP market across multiple countries remained pressured by macroeconomic factors which weakened the demand for both consumer and commercial segments. Breaking down the YoY performance of each product type: total Inkjet portion declined by 15.1%; Laser devices, including A4 and A3 machines, declined by 13.5%; and Serial Dot Matrix (SDM) segment declined by 26.4%.

In most of the sub-regions like ANZ, ASEAN, Greater China and India, ink cartridge shipments witnessed a notable decline. This was primarily due to slower-than-anticipated ink cartridge replacement rates by home users. Conversely, the ink tank segment captured YoY growth in countries like Australia, Philippines, Bangladesh, Indonesia, and India due to the growing acceptance in major verticals, such as healthcare and education, in a predominantly small and medium business (SMB) driven market.

In Q3, both laser A4 and A3 markets declined significantly, with the A3 market declining by 18.7% and A4 by 12.8%. This was largely due to a subdued demand from SMBs and small offices/home offices (SOHOs) remained soft in many countries, compounded by the global economic hurdles which further tightened their business spending.

However, India stood out in the APeJ region, being the only country to achieve a YoY growth for both laser printers and copiers, primarily driven by large government tender fulfilments ahead of the anticipated general election in Q2 2024.”Despite total unit shipments for laser products being lower than forecasted, we anticipate that demand will recover in certain countries in the short run as government and business spending will pick up again in tandem with economic recovery,” said Yi Karl Tai, Research Analyst, IDC Asia Pacific.

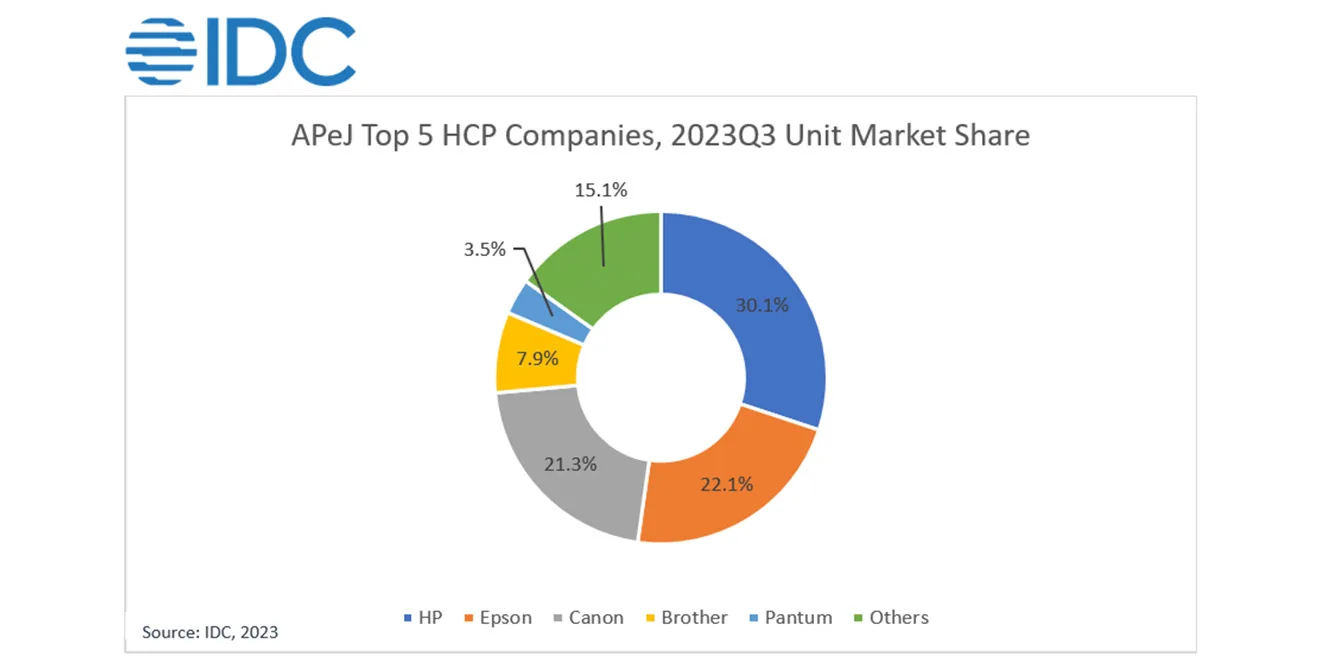

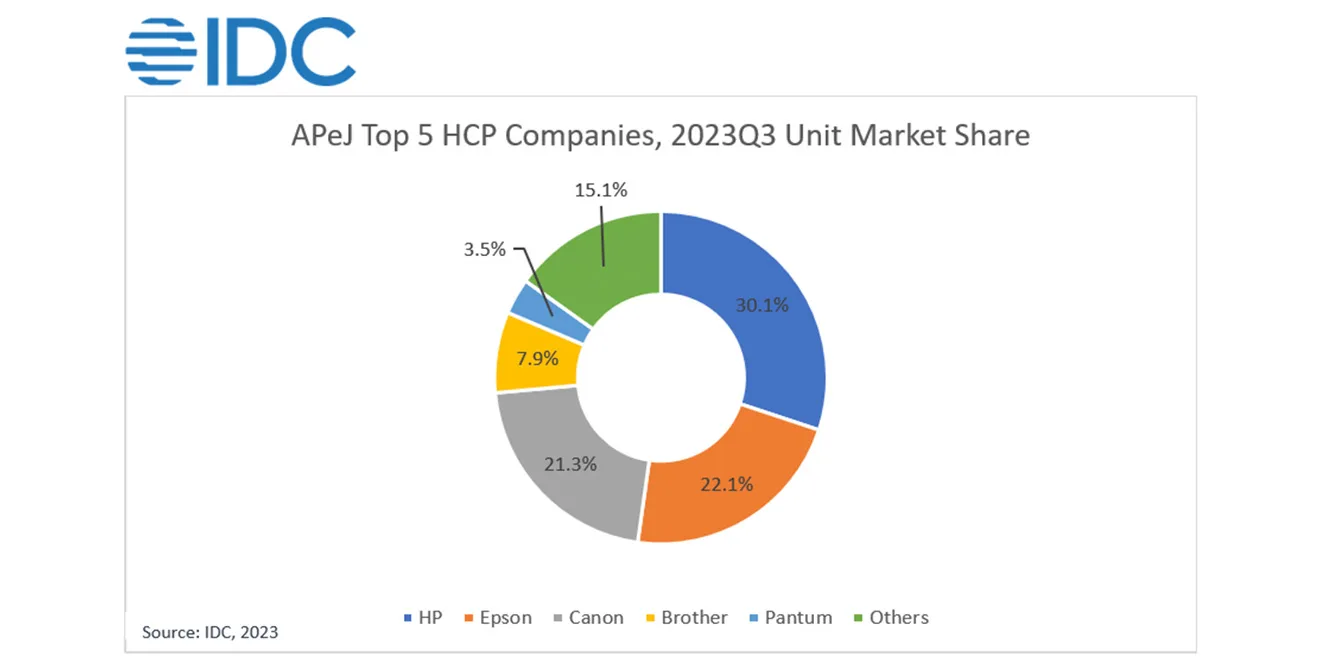

Top three home/office printer brand highlights:

- HP once again crossed the 30% market share threshold despite a slight decrease in shipments. With new projects secured from the private and public sectors in 3Q23, HP maintained their steadfast position. The highest YoY growth was seen in Vietnam and Sri Lanka.

- Epson had a slight edge over Canon in Q3 compared to a tie in the previous quarter. Epson continued to lead the ink tank segment, thanks to widening acceptance of ink tank models in the larger market, particularly among SMBs and home users. This quarter, the Philippines recorded the highest YoY growth, followed by Bangladesh and Indonesia.

- Canon placed third in 3Q23 with a slight YoY drop in total unit shipments. With stronger demand in healthcare, manufacturing, and education for their laser products, and the rollout of more inkjet models in their continued shift from ink cartridge to ink tank models, Canon managed to keep their growth in parts of Asia. The highest YoY growth occurred in Malaysia, followed by India and Korea.

“In line with IDC’s prediction, we see Q3 shipments smoothening before the end of 2023, where shipments are expected to rebound in Q4. We expect the shift from ink cartridges to ink tanks will continue, as ink tank models increase in popularity across sub-regions like ANZ, ASEAN and major markets like China and India. End users are making this transition to increase efficiency in printing, in line with an increasing awareness of ESG,” said Leonard Adiarto Sudjono, Senior Research Analyst at IDC Asia Pacific.