CONTEXT, the IT market intelligence company, launched a new distribution forecasting report designed to help channel businesses plan more effectively for the second half of 2021 and beyond.

The CONTEXT Forecasting Report features market data from European distribution across five key sectors: PCs, server & enterprise storage, enterprise networking, displays and printing. The countries covered are the UK, Germany, Italy, France and Spain.

It combines this with CONTEXT analysts’ detailed category knowledge and expert input from IT vendors, distributors and resellers across the channel, to help readers better anticipate the shape and pace of market recovery.

It combines this with CONTEXT analysts’ detailed category knowledge and expert input from IT vendors, distributors and resellers across the channel, to help readers better anticipate the shape and pace of market recovery.

This edition, for Q3 2021, features actual year-on-year quarterly performance figures up to Q2 2021, and projected unit and revenue growth forecasts to Q4 2021. Future reports will take a similar approach.

“Knowledge is power. And at a time like today, it’s never been more important to those channel businesses looking to manage the current situation in the strongest possible way,” said CONTEXT Global Managing Director Adam Simon “That’s why we’ve developed this new source of market intelligence: it’s designed to help clients plan with greater confidence as the region begins to recover from a volatile 18 months.”

CONTEXT forecasts for the remainder of the year:

- PCs: Continued healthy mobile computing demand driven by hybrid working and smaller education projects. Consumer demand may slow if pandemic restrictions ease, while continued supply issues will affect the availability of notebooks and desktops.

- Server & enterprise storage: Infrastructure spending growth will continue in Q3 and Q4, boosted by public investment and a rebalancing of IT budgets away from PCs. However, component shortages will delay growth

- Enterprise networking: Public investment, especially the EU COVID relief fund, will boost enterprise sales, while IoT projects and hybrid working patterns will drive wireless revenues. Increased delivery times due to component shortages will delay growth.

- Displays: Gaming will continue to drive the consumer sector while businesses are starting to invest more in displays for remote workers and office-bound staff as the pandemic recedes. Prices for monitors will stabilise and drop by the year end, especially for consumer models.

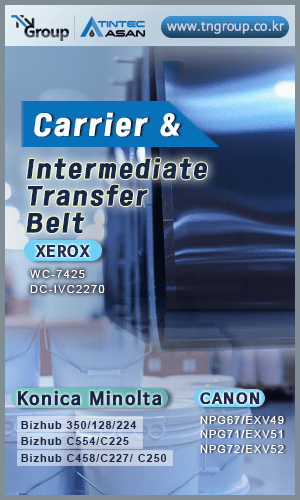

- Printing: As offices reopen in H2 2021, business print volumes will recover and demand for toner will increase. However, the distribution channel is facing shortages and volatility due to disruption in the supply chain and component production lines.