At the moment there is no clear evidence that print sales in January 2020 have been affected by the coronavirus according to the latest distribution data published by CONTEXT, the IT market intelligence company.

CONTEXT adds that print performance could be weaker in Q1 2020, however, and the extent of this depends on how quickly the spread of the virus can be contained.

The speed of the spread will also determine whether there will be an impact on one quarter, two quarters or more. CONTEXT also believes that there will be an impact on component supply, and Q2 shipments are likely to be affected. If it takes longer than the end of March to contain the virus, a bigger impact is expected with production and demand possibly shifting to 2H 2020.

Considering this, vendors might push their customers to bring project-based purchases forward, as waiting could mean that shortages will have a knock-on effect on pricing and customers will then end up paying a premium price, according to CONTEXT.

The ongoing shutdown of operations by China’s major tech manufacturing centres in response to the new coronavirus could have a massive knock-on effect on project fulfilment across Western Europe, and it could, in addition to the disruption caused by the Trade War (between U.S. and China) also have a lasting impact on global supply chains, CONTEXT added.

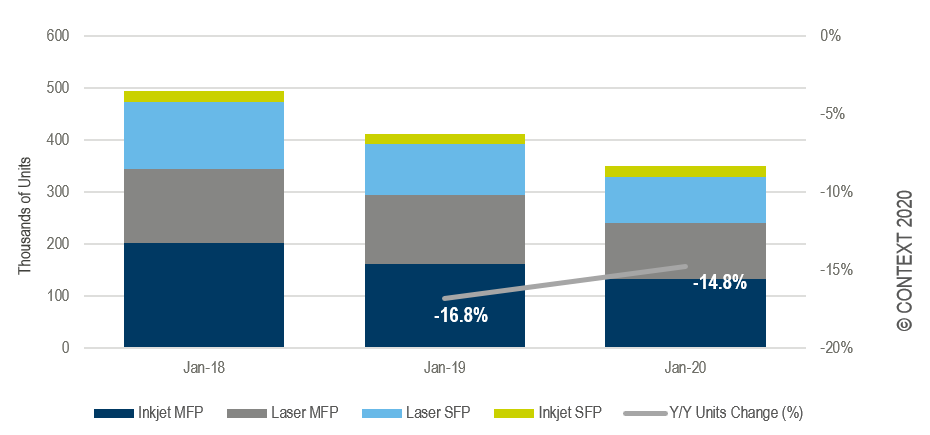

The start of Q1 2020 saw printer sales continue to follow the pattern that has characterised the past few quarters, with healthy demand for consumer multifunction printers (MFPs), according to the latest distribution data published by CONTEXT, the IT market intelligence company.

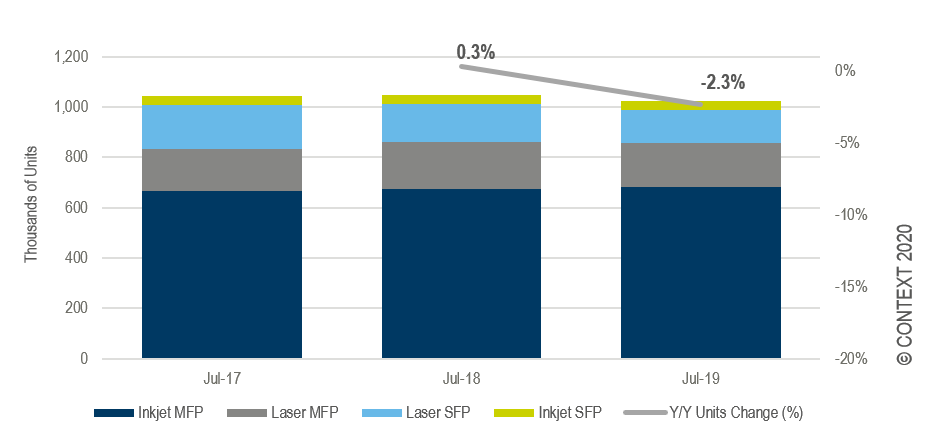

However, volume sales of printers through the largest distributors in Western Europe were down by 2.3% year-on-year in January 2020. Although the consumer segment saw sales increase by 5.8%, mainly driven by good performance from inkjet MFPs (up 7.5%) and laser MFPs (which saw exceptional growth of 22.8%), sales of single-function printers (SFPs) in this market continued to fall sharply (down 11.6% for inkjet SFPs, and down 23.8% for laser SFPs).

Sales of, and revenues from, consumer inkjet MFPs increased in almost all Western European countries during January 2020 with the United Kingdom seeing the strongest growth (34.7% in terms of units and 20.4% in revenues). In Italy, consumer printer sales also continued to rise (year-on-year increases of 2.9% in units sold and 6.2% in revenues) with most retailers and small resellers benefiting from minimum order sizes and credit lines offered by the Distribution channel.

Looking at the business targeted-customer segment (which account for 34% of printer sales and 67% of revenues in Western Europe), we saw a sharp decline in early Q1 2020. The fall of 14.8%, mainly driven by poor performance of MFPs across almost all countries (sales of both inkjet and laser MFPs were down by 18.5%), led to a drop of 11% in revenues. This trend in MFP sales is likely to change in the coming months, particularly in Italy where the recent award of a government tender/contract for multifunction and Managed Print Services (MPS) for Public Administrations (Regional/Municipal offices) with an overall value of €100 million ($111 million) will push up sales in this category.