European shipments of printing consumables declined in H1 2022, according to IDC.

One aftereffect of the COVID-19 pandemic is the apparent permanence of hybrid working. Faced with the slow return of workers to offices, along with political and economic uncertainty and high inflation rates, printing suppliers in Europe are having a hard time, IDC said. Reduced investment on printing is likewise affecting the consumables market.

According to the Semi-annual Consumables Tracker published by International Data Corporation (IDC), the total value of shipped consumables in the first half of 2022, exceeded $4.77 billion (€4.53 billion), although this represented a decline of 11.8% from H1 2021.

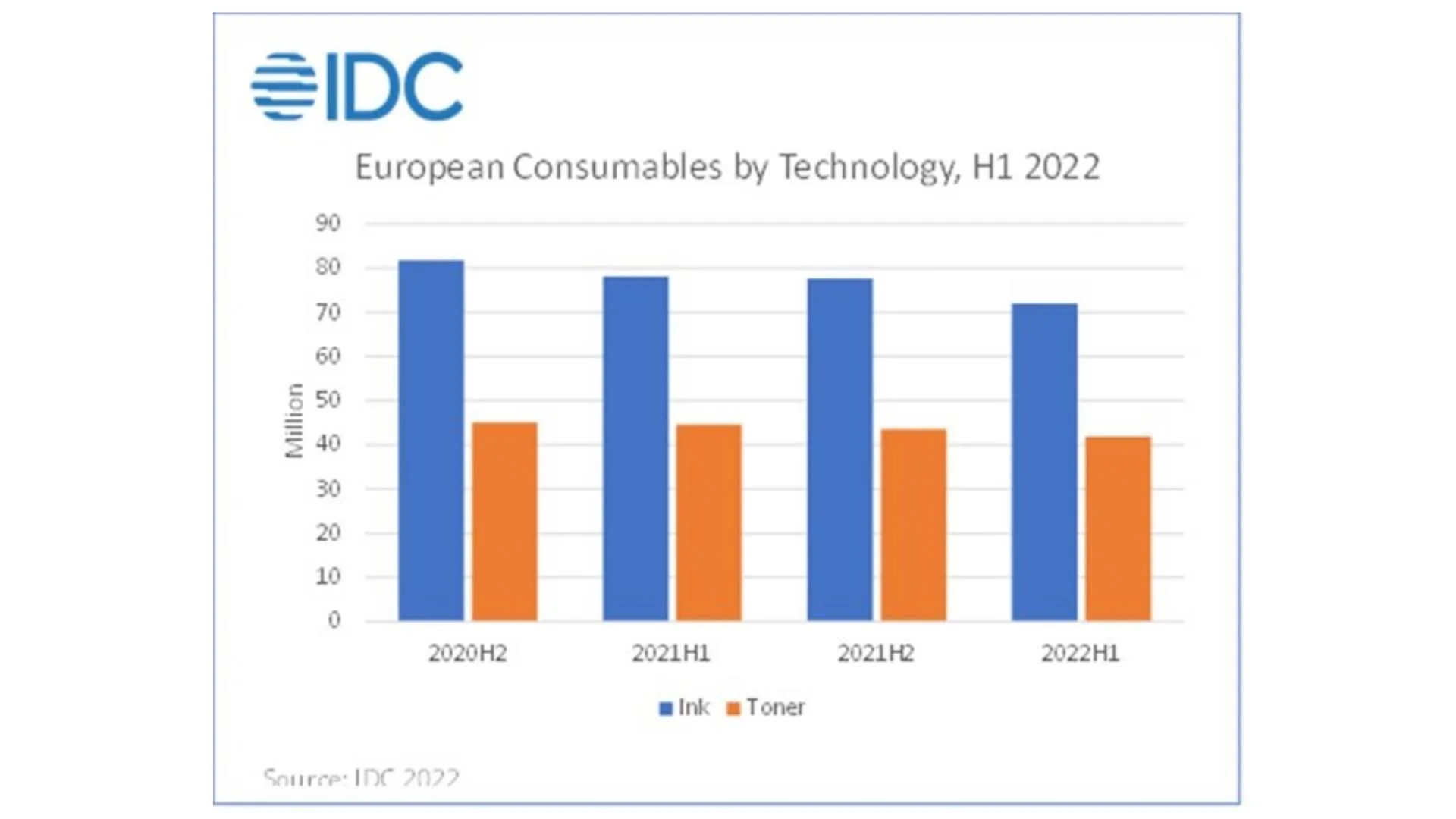

Total shipments for cartridges and bottles for inkjet devices reached 72 million units, reflecting a contraction of 7.7% year-on-year, although ink tank shipments in most countries increased. The declining installed base, wider adoption of continuous supply ink system devices, and lower demand from the consumer segment negatively impacted overall H1 2022 results, according to IDC. The toner market in Europe was valued at $3.34 billion (€3.17 billion) following a 11.3% year-on-year decline. The OEM and aftermarket brands shipped nearly 41 million units of consumables for laser printers and MFPs.

Total shipments for cartridges and bottles for inkjet devices reached 72 million units, reflecting a contraction of 7.7% year-on-year, although ink tank shipments in most countries increased. The declining installed base, wider adoption of continuous supply ink system devices, and lower demand from the consumer segment negatively impacted overall H1 2022 results, according to IDC. The toner market in Europe was valued at $3.34 billion (€3.17 billion) following a 11.3% year-on-year decline. The OEM and aftermarket brands shipped nearly 41 million units of consumables for laser printers and MFPs.

According to IDC’s EMEA IPDS Survey, conducted during the COVID-19 pandemic, 66% of respondents said that they have used non-genuine/compatible cartridges, due to disrupted supply chains and component shortages of original consumables. Approximately two-thirds have continued or will continue to use non-genuine/compatible ink and toner cartridges even after original consumables become available, which represents an opportunity for compatible consumable vendors.

Supply chain and logistics issues, as well as shortages of raw materials and components, continue to plague the printing industry. Sustainability and environmental concerns and digitisation processes are additional inhibiting factors. On the other hand, the subscription model is gaining in popularity, as it offers businesses of various sizes flexibility in times of uncertainty.

IDC’s Semi-annual Consumables Tracker covers countries the Czech Republic, France, Germany, Hungary, Italy, the Netherlands, Poland, Russia, Spain, Ukraine, and the United Kingdom

“Several waves of disruption have swept across Europe in recent years, negatively impacting printing markets, particularly suppliers of OEMs,” said Michal Swiatek, IDC Research Manager for Imaging Printing & Document Solutions in Europe. “We expect the uncertain environment to persist in the near term, which is not conducive for consumables sales.”