The number of corporate insolvencies increased in Germany in July, the Federal Statistical Office announced on Friday (11 August).

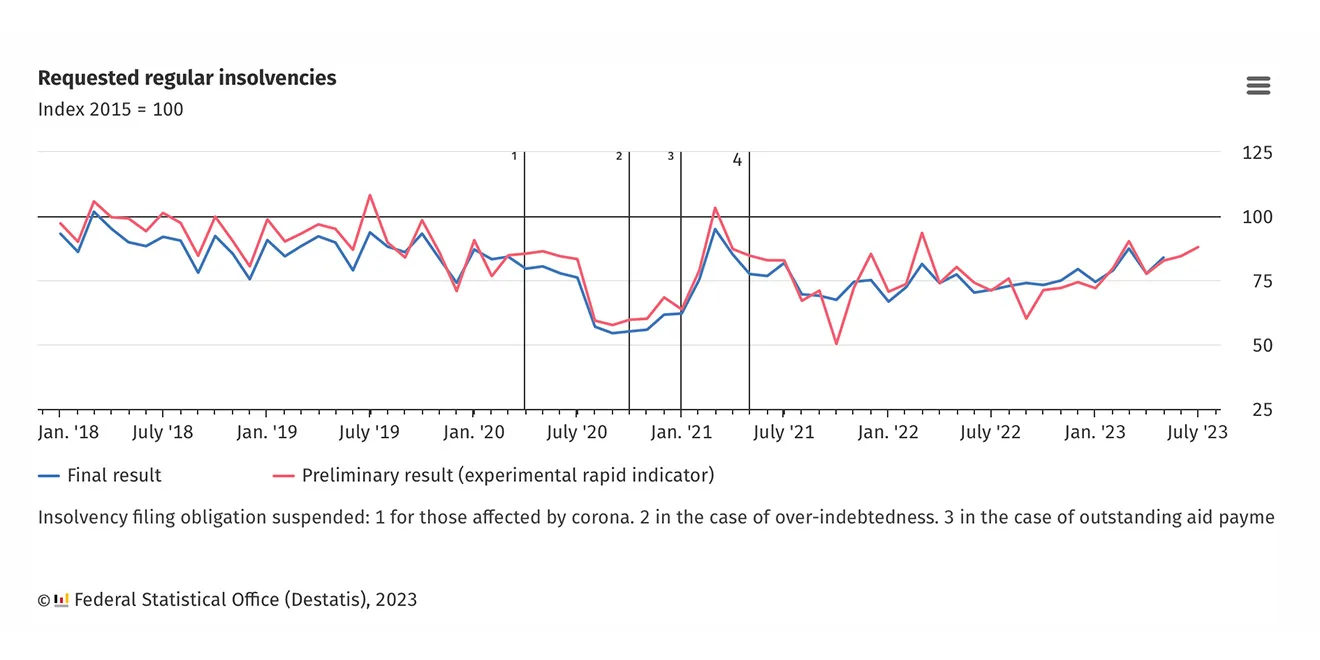

Recent data published by the Federal Statistical Office (Destatis) indicates a significant shift in insolvency trends within Germany. July 2023 saw a notable surge of 23.8% in regular insolvency applications compared to the same period last year. This follows a prior increase of 13.9% in June 2023 compared to June 2022.

The latest data highlights a noteworthy development in the corporate sector. In May 2023, German local courts recorded 1,478 applied corporate insolvencies based on finalized results. This figure signifies a substantial increase of 19.0% when contrasted with the insolvencies recorded in May 2022. The upward trajectory in corporate bankruptcies has been consistent since August 2022.

These insolvency cases in May 2023 amounted to almost 4.0 billion euros in creditors’ claims, a significant rise from the approximately 2.2 billion euros recorded in May 2022.

In the broader context, among a sampled 10,000 companies, Germany observed a total of 4.4 corporate insolvencies in May 2023. Within this framework, transport and storage were most susceptible to bankruptcies, with a frequency of 8.7 cases per 10,000 companies. Other economic services, including temporary employment agencies, followed closely with 7.4 instances. In contrast, the energy supply sector displayed the lowest frequency, with a mere 0.3 insolvencies per 10,000 companies.

Shifting the focus to consumer insolvencies, May 2023 marked a distinct shift in the opposite direction. The recorded consumer insolvencies numbered 5,679, reflecting a notable decrease of 3.7% when compared to the figures of May 2022.