HP Inc’s CEO, Enrique Lores, uses the Q4 2020 results, earnings call to confirm the company continues “to evolve our print business models with our drive towards services and a rebalance of profitability between hardware and supply.”

HP Inc’s CEO, Enrique Lores, uses the Q4 2020 results, earnings call to confirm the company continues “to evolve our print business models with our drive towards services and a rebalance of profitability between hardware and supply.”

In the recent HP Q4 2020 results, earnings call CEO Enrique Lores told the audience of analysts “We continue to evolve our print business models with our drive towards services and a rebalance of profitability between hardware and supply.” A first hint at the plan announced over a year ago to raise printer prices for customers who didn’t want to use HP-branded supplies.

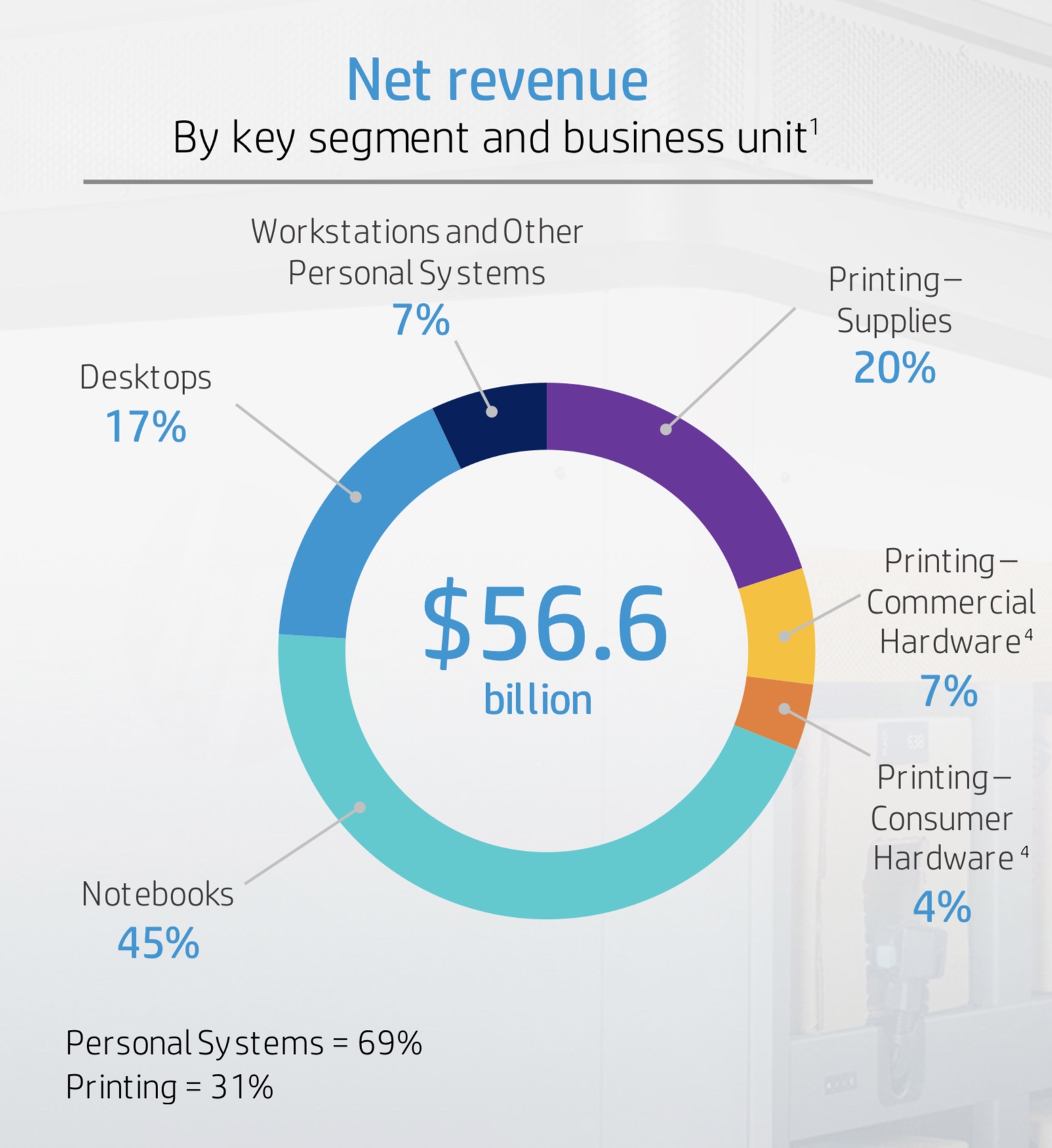

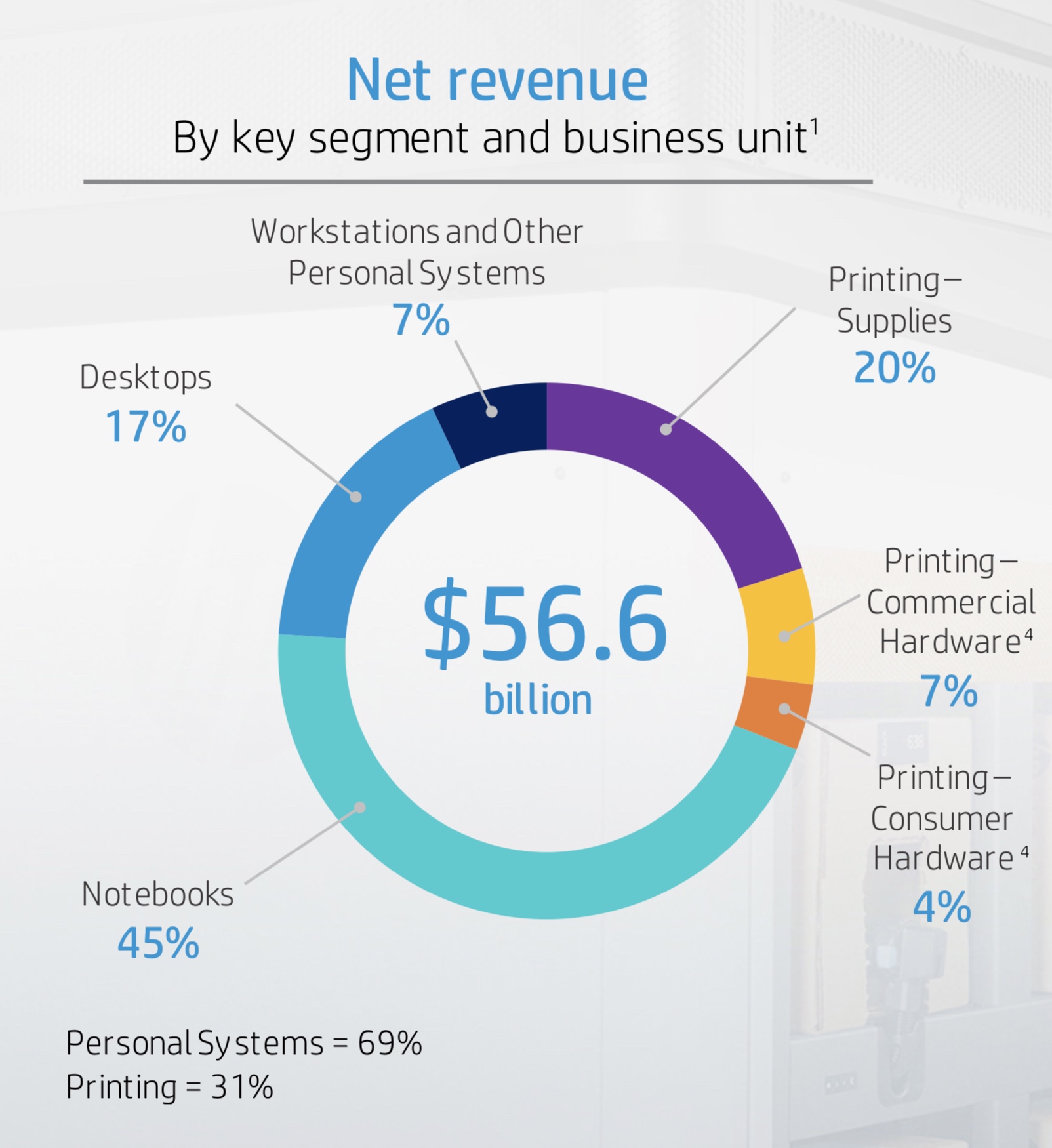

Printing now accounts for just 31% of HP’s revenue and the bulk (65%) of that is the supplies segment. Supplies is a competitive space where reuse and new build alternatives are carving out a strong market share as bit as 45% in some markets.

Lores reported that the “strong consumer business is a clear advantage for us, and the shift to remote work and school continues to create momentum in home printing.” But expects the strength in home will gradually subside when more offices and schools reopen.”

Instant Ink

Instant ink continues to grow and has passed the companies 8 million subscriber target, and Lores confirmed that HP plans to extend HP Plus “end-to-end platform strategy” that ties customers into only using HP ink, which “provides a differentiated value proposition for our loyal customers,” said Lores.

What he didn’t say in the earnings report is that the print-free-for-life tier of their instant ink programme is ending. Designed to lure the consumer in, the print-free-for-life was limited to 15 pages a month.

The Instant Ink free tier is being scrapped, and users will have to start paying HP a monthly fee or the printer will stop working. Prices are now $0.99 / €0.99 a month for 15 pages with the ability to roll over up to 45 unused pages.

Margins

Gross margin was 17.6%, down 1.4 points year-on-year. The decline was due to a combination of a higher consumer mix within both personal systems and print hardware and lower rate in commercial print.

Supply change shortages in Q2, Q3 and Q4 reduced HPs ability to supply many key resellers. HP expects this to continue in the early part of 2021 because of ongoing demand on the consumer side of supplies. Driven by people working from home and kids learning from home.

“Together, we expect these actions will help us to optimize the business by reducing the number of unprofitable customers.”

Q4, ended 31 October, revenues were of $15.3 billion flat year-over-year. With full year revenue of $56.6 billion, down 3.6% from the prior-year period. Business sales were down, and consumer sales were up.

Print revenues for in Q4 were $4.8 billion, Ful year revenues were $17.6 billion, down 21.1% from the prior-year period. Gross margin was 17.6%, down 1.4 points year-on-year. The decline was due to a combination of a higher consumer mix within both personal systems and print hardware and lower rate in commercial print.

Editorial Opinion: HP expects home use to decline in coming quarters and commercial print to strengthen, which it will, but to what level? Hardware sales are only 35% of the print business now. Will selling cheap printers with locked in consumables grow, or will consumers who already have printers, just rebel at the higher prices and go off-brand for reused and new-build?