According to new data released by IDC, the Hardcopy Peripherals market in India recorded its fourth consecutive quarter of yearly growth in Q2 of 2018.

According to new data released by IDC, the Hardcopy Peripherals market in India recorded its fourth consecutive quarter of yearly growth in Q2 of 2018.

The IDC Asia Pacific Quartlery Hardcopy Peripherals Tracker, CY2018Q2 reveals that inkjet shipments grew by 30.6 percent year-on-year with a contribution of 48.1 percent to the overall India HCP market.

Growth in inkjet printer shipments was led by ink tank printers, which also recorded quarter-on-quarter growth of 4.6 percent. Laser printers, including copiers, also saw a year-on-year growth of 19.6 percent with a contribution of 47.4 percent to the overall market.

“Except for 2017Q2, which was largely affected by the impact of GST implementation, 2018Q2 has been the best quarter so far for ink tank printers with shipments accounting for 68 percent of total inkjet printers compared to 52 percent a year ago,” asserted Bani Johri, Market Analyst, IPDS, IDC India. “Promotional activities by the top players targeted at both the end users and distributors has translated into increased ink tank shipment.”

Johri continued: “In Laser HCP (printer-based), shipments for SFP printers overtook MFP printers, primarily due to increased availability of top-selling models which were facing supply issues till about last year. Laser HCP (Copier-based) also registered strong year-on-year growth of 24.8 percent, owing to the government’s crackdown on the reconditioned copier market, coupled with increased refresh and fresh purchase from government and enterprises.”

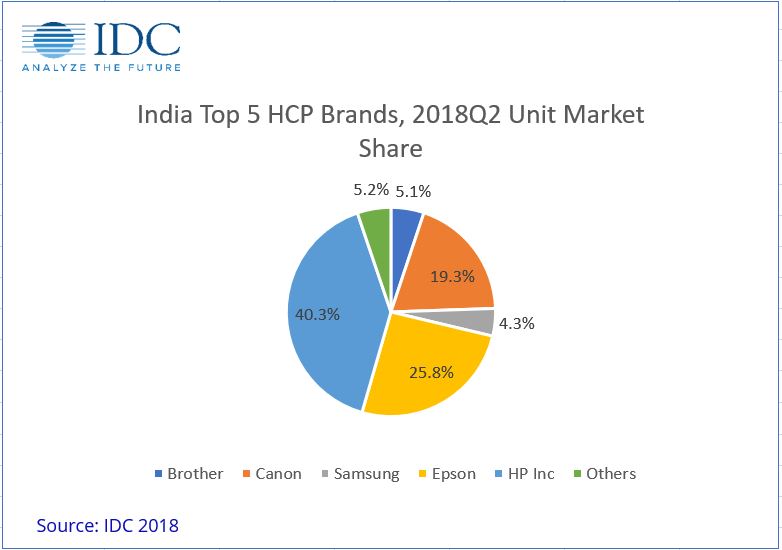

Amongst the OEMs, HP Inc. (excluding Samsung) maintained its leadership in HCP with a market share of 40.3 percent and a 5.3 percent year-on-year growth. The launch of new ink tank models during the quarter and increased promotional activities – such as becoming team sponsors in the Indian Premier League, India’s flagship annual cricketing event – coupled with improved customer service helped drive the growth. In the inkjet segment HP remained in 2nd position, with a share of 32.4 percent. The OEM increased its Laser HCP (printer-based) shipment by 14.5 percent over 2017Q2 owing to strong SMB demand and government deals. While there was marginal growth around laser HCP (copier-based), HP jumped ahead of the likes of Kyocera, Konica Minolta and Sharp in 2018Q2 and was 2nd in the overall copier market with a market share of 12.8 percent.

Epson meanwhile remained at 2nd position in the overall HCP market by clocking 73.9 percent year-on-year growth, partly due to relatively low shipments in 2017Q2. It continued its leadership in the inkjet segment by retaining its leadership with a unit share of 47.7 percent and an 80.7 percent year-on-year growth, primarily due to Epson’s low shipment volume in 2017Q2 which in turn was as a result of their decision to reduce channel inventory to prepare for GST launch.

Canon recorded year-on-year growth of 15.8 percent, and maintained its 3rd position in the HCP market. The laser copier segment helped Canon in clocking a year-on-year growth of 45.4 percent. In the copier segment, it maintained its leadership with a 37.7 percent unit market share. Low shipment from competing vendors, coupled with Canon’s increased focus on entry-level copier machines through aggressive promotions, helped them maintain their dominance in the copier market. In the inkjet market, Canon saw a strong year-on-year growth of 27.8 percent, as a result of their increased promotional activities around ink tank models.