India’s HCP market records an improved performance recording a 103.5% year-on-year growth in 2Q21, reports IDC.

According to the latest data released by International Data Corporation (IDC), India’s hardcopy peripherals (HCP) market registered shipments of 0.7 million units in 2Q21 (Apr-Jun), declining by 24.1% quarter-over-quarter (QoQ). However, from a year-over-year (YoY) perspective, the market posted a growth of 103.5% in the Apr-Jun quarter, according to the IDC Worldwide Quarterly Hardcopy Peripherals Tracker, 2Q21 release.

However, IDC added that this highest-ever recorded growth rate is accounted for by the extremely shallow base last year in Q2, due to the country-wide lockdown.

The inkjet segment noted a YoY growth of 71.9%, accounted partly by the low shipment units in 2Q20 and partly by the continued demand from the home segment in 2Q21. As schools and colleges were forced to continue the virtual classes, demand from parents and students remains strong. However, this demand could not be fully fulfilled because of the disruption in the local supply chain due to lockdown in multiple states owing to the second COVID-19 wave.

In addition, the chip shortage issue has also been plaguing the industry, already resulting in brands struggling to stabilize the supply of in-demand ink tank printers specifically.

The laser printers segment (including copiers) recorded a YoY growth of 175.1% on the back of a strong showing of laser printers (excluding copiers) since SOHOs (small offices, home offices), SMBs, and few medium-sized corporates did not shut down operations completely during the second wave, unlike last year. The laser copier segment observed a minor YoY growth of 27.8% as most enterprises extended work-from-home for their employees during the second wave.

“At 66.7% market share, the laser A4 multifunction printer segment recorded its highest market share till date. For some brands, like HP, it resulted from strategic decisions to pull certain 12A toner-based printers out of the market. For others such as Brother, it was a result of multiple stringent lockdowns in Vietnam, the production hub of certain single-function machines by the vendor. Within the laser copier segment, certain brands performed very well in the colour category, thus bringing up the overall market share of the colour category in laser copiers to 15.2%, being highest till-date. This follows acceptance of new models launched last year and lucrative pricing options offered,” noted Bani Johri, Market Analyst, IPDS, IDC India on the key market trends.

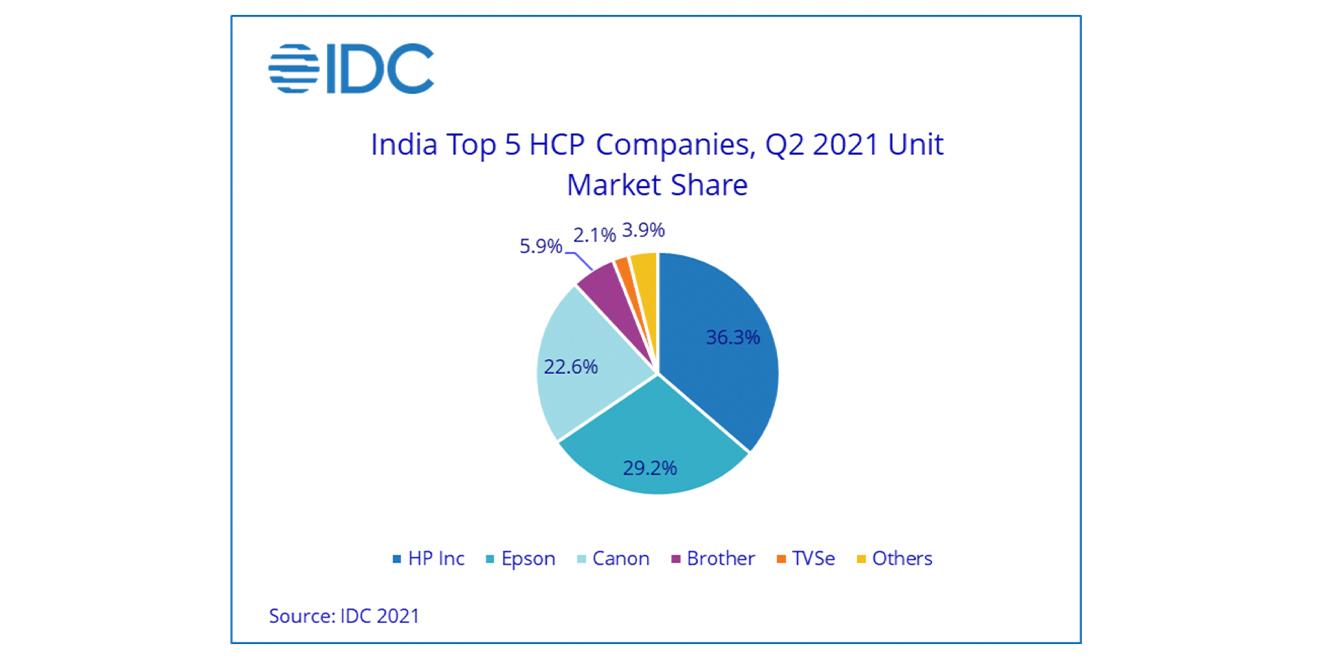

Top 3 Company Highlights:

HP Inc. (excluding Samsung) maintained its leadership in the overall HCP market with a share of 36.3% and a YoY growth of 148.3% in shipment. The growth was led by the laser A4 printer segment, wherein HP grew by 396.9% YoY, maintaining a market share of 57.5%, like the previous quarter. The exponential growth follows the acute supply shortage HP faced in 2Q20. In the inkjet segment, HP grew by 47.4% YoY, primarily on the back of its ink cartridge shipment as HP’s ink tank supply was disrupted through 2Q21.

Epson occupied the second position in the overall HCP market with a market share of 29.2% while registering a YoY growth of 103.8%. In the inkjet segment, it maintained its top position in the market with a share of 47.0%. The fact that Epson did not face a major supply shortage of its fast-moving models through the quarter contributed to their growth.

Canon recorded a YoY growth of 79.9% and occupied third position in the overall India HCP market, capturing a unit market share of 22.6%. In the inkjet segment, Canon observed a YoY growth of 64.1% on the back of its ink cartridge segment, even though it struggled with the supply shortage of certain ink tank models. In the laser segment (including laser copiers) Canon maintained its second position with a market share of 25.0% while struggling with the supply of its highest selling models. In the laser copier segment, Canon grew by 43.2% YoY and continued to lead the copier segment with a 35.8% market share.

“Various constraints such as chip shortages, rising component prices, and increased fuel and transportation costs will continue to impact the supply of printers. However, we can expect continued demand for ink tank printers from consumer segment as virtual classes continues for most students. Enterprise demand is dependent on two factors, i.e., possible third wave and staff vaccination. Many large enterprises are planning to get 100% staff fully vaccinated within next couple of months before resuming offices which can boost laser copier demand in Q4,” said Nishant Bansal, Senior Research Manager, IPDS, IDC India.