The new worldwide quarterly industrial printer tracker from International Data Corporation (IDC) shows that industrial printer shipments were significantly impacted by the COVID-19 crisis on a worldwide basis in the second quarter of 2020 (2Q20).

The new worldwide quarterly industrial printer tracker from International Data Corporation (IDC) shows that industrial printer shipments were significantly impacted by the COVID-19 crisis on a worldwide basis in the second quarter of 2020 (2Q20).

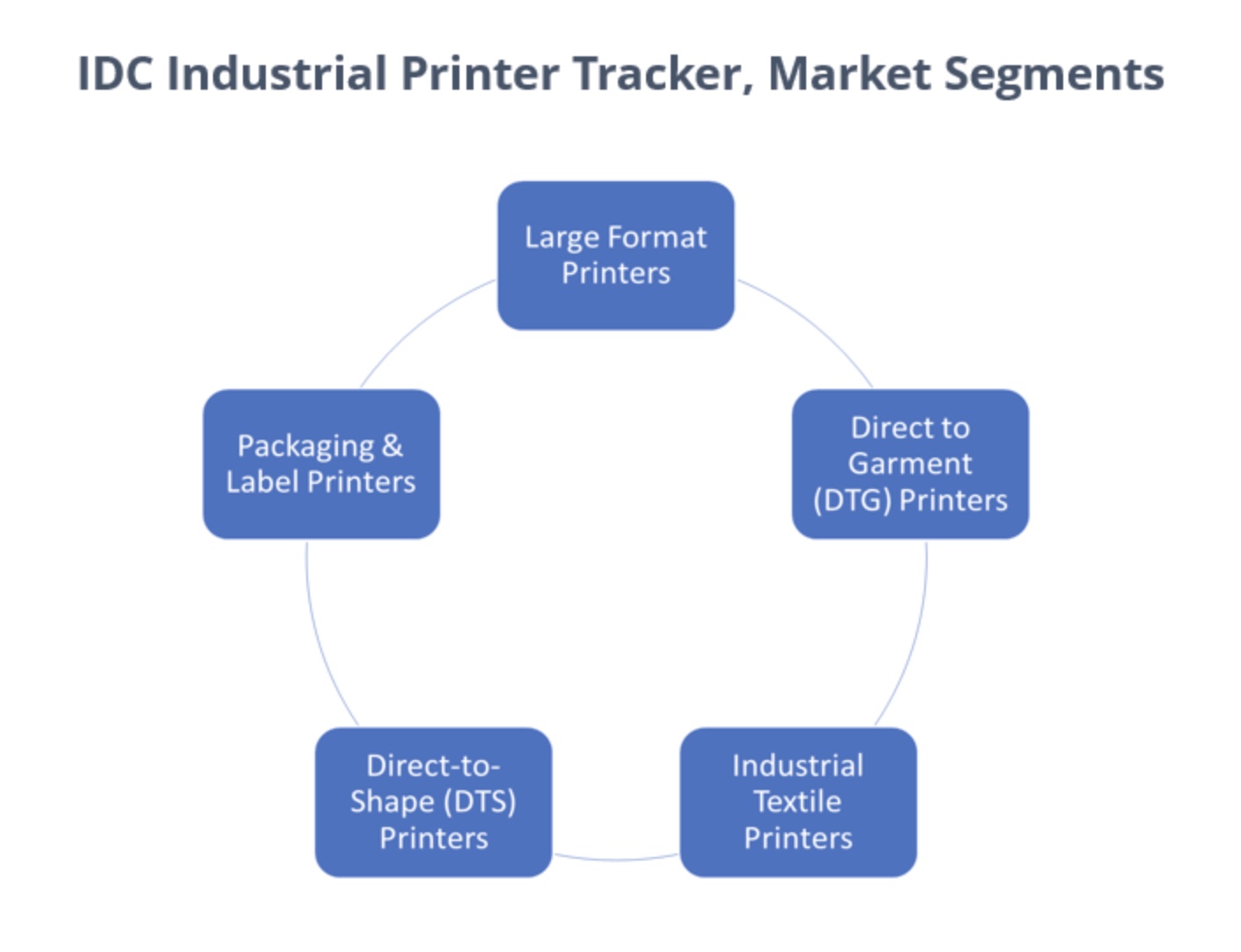

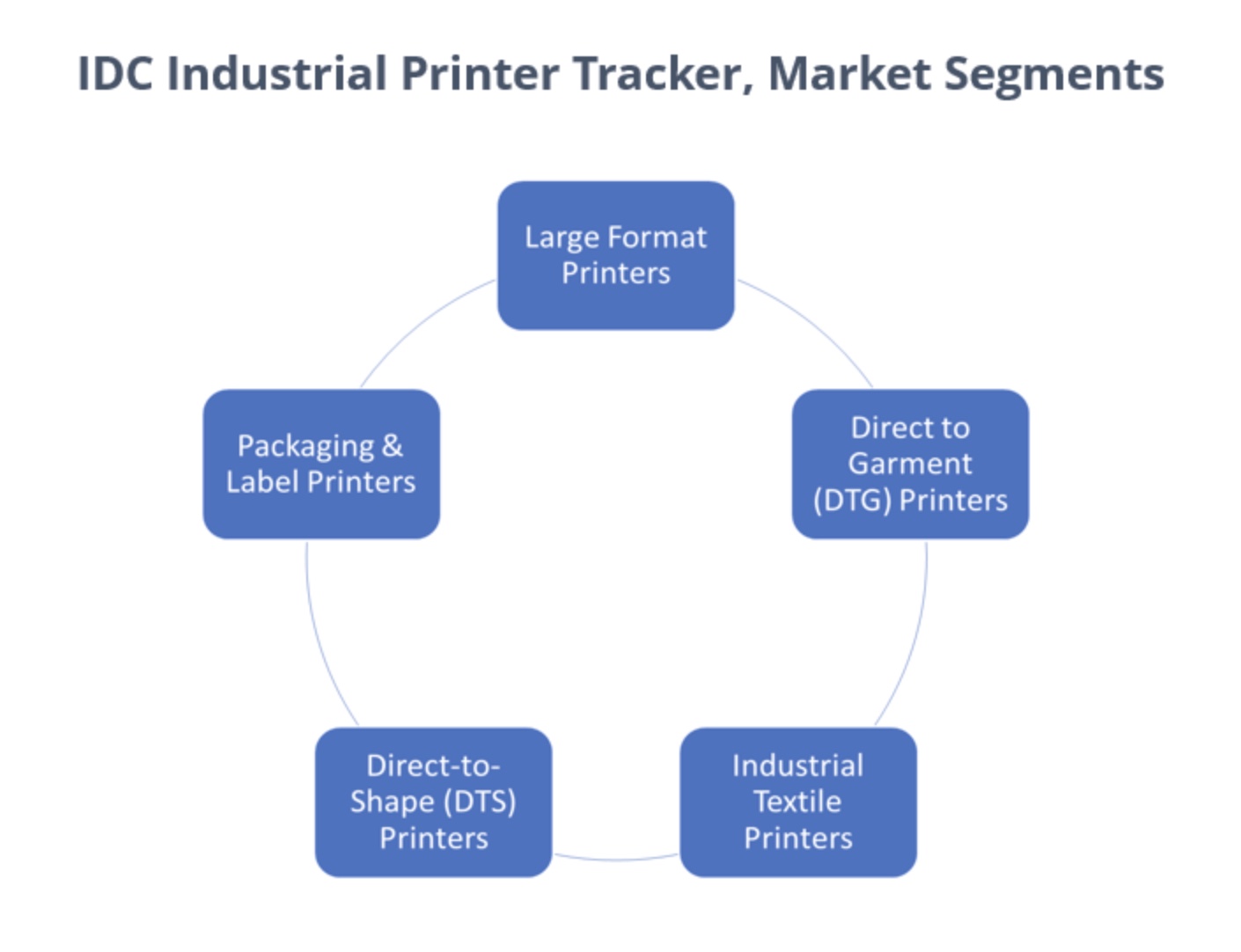

The industrial printer market, comprised of the large-format, packaging & label, direct-to-shape, direct-to-garment, and industrial textile printer segments, saw worldwide shipments decline 46.8% year-over-year in 2Q20.

“With much of the world still in shutdown or just starting to come out of shutdown at the end of the second quarter, no segment or region was spared,” said Tim Greene, research director, Hardcopy Peripherals at IDC. “While our research indicates many global manufacturers are rethinking supply chains to meet resilience and sustainability goals, those are longer-term initiatives. Shipments and hardware revenue across the large format and industrial printer market have declined due to near-term challenges such as government shutdowns and capital budget cuts.”

The Asia/Pacific region showed the start of a recovery in the second quarter, with shipment growth compared to Q1 in the direct-to-shape, industrial textile, large-format, and label & packaging segments. Shipments in North America declined by over 20% while shipments in Europe declined by almost 42% compared to Q1.

Worldwide shipments in the direct-to-garment segment declined just over 20% in 2Q20 compared to the first quarter. Shipments in the direct-to-shape segment declined by over 26% in 2Q20 compared to 1Q20. Industrial textile printer shipments contracted just 7% compared to 1Q20, with growth in the Asia/Pacific region offsetting declines in other regions. Label & packaging unit shipments declined 12.5% in 2Q20 compared to the first quarter. Large-format printer shipments declined almost 25% worldwide in 2Q20 compared to 1Q20.

Looking ahead, IDC expects both units and shipment value will stabilise in the second half of 2020 as the different geographic regions go through different phases of recovery. 2021 is still expected to be a recovery year as IDC anticipates economic recovery and supply chain digitization to drive investments in more flexible manufacturing technologies such as industrial printing solutions.