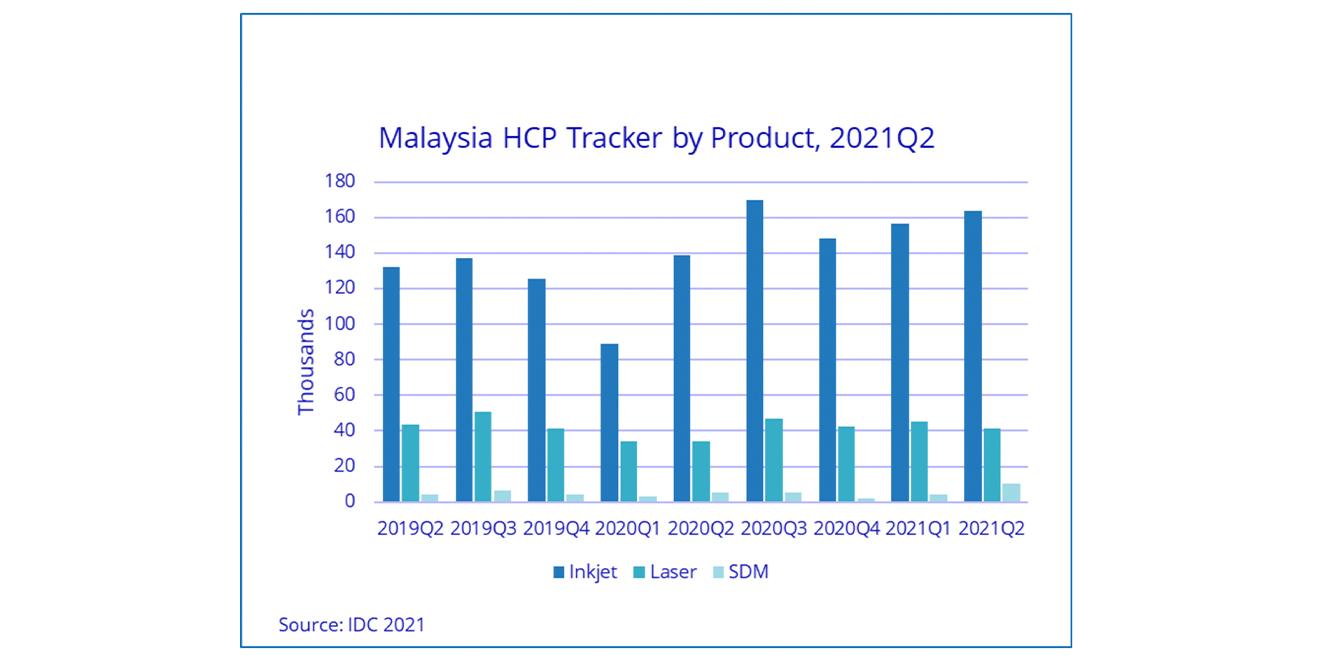

According to the International Data Corporation’s (IDC) Quarterly Hardcopy Peripherals Tracker, Malaysia’s HCP (Hardcopy Peripherals) shipments, comprising inkjet, laser, and SDM, showed a growth of 4.6% QoQ and 21.1% year-on-year (YoY).

The high YoY growth is attributable to the high demand for entry-level printers for work and learning from home purposes since 2020Q2 due to recurring lockdowns. Parents would purchase an entry-level printer for printing their children’s school materials and teachers would have to print and distribute modules to students who do not have electronic devices to access online classes.

While the global shortage of semiconductors and chip supply has led to an increase in printer pricing due to higher supply costs, this has not hindered end-users from purchasing them, IDC said. Any further delay in school reopening will result in sustained demand for home-based printers, according to IDC.

The demand from large corporates and small and medium enterprises (SMEs) remained low in 2021Q2 as there was a stricter lockdown in May and June. The uncertainty caused by the pandemic and businesses trying to stay afloat since the start of the outbreak last year meant that investing in new print devices may not be their top priority as they prioritise on managing their cash flow. As the pandemic has led to many processes being shifted online, many physical appointments and physical documents are not required anymore. This is true not only for the private sector but for the public sector as well, IDC explained.

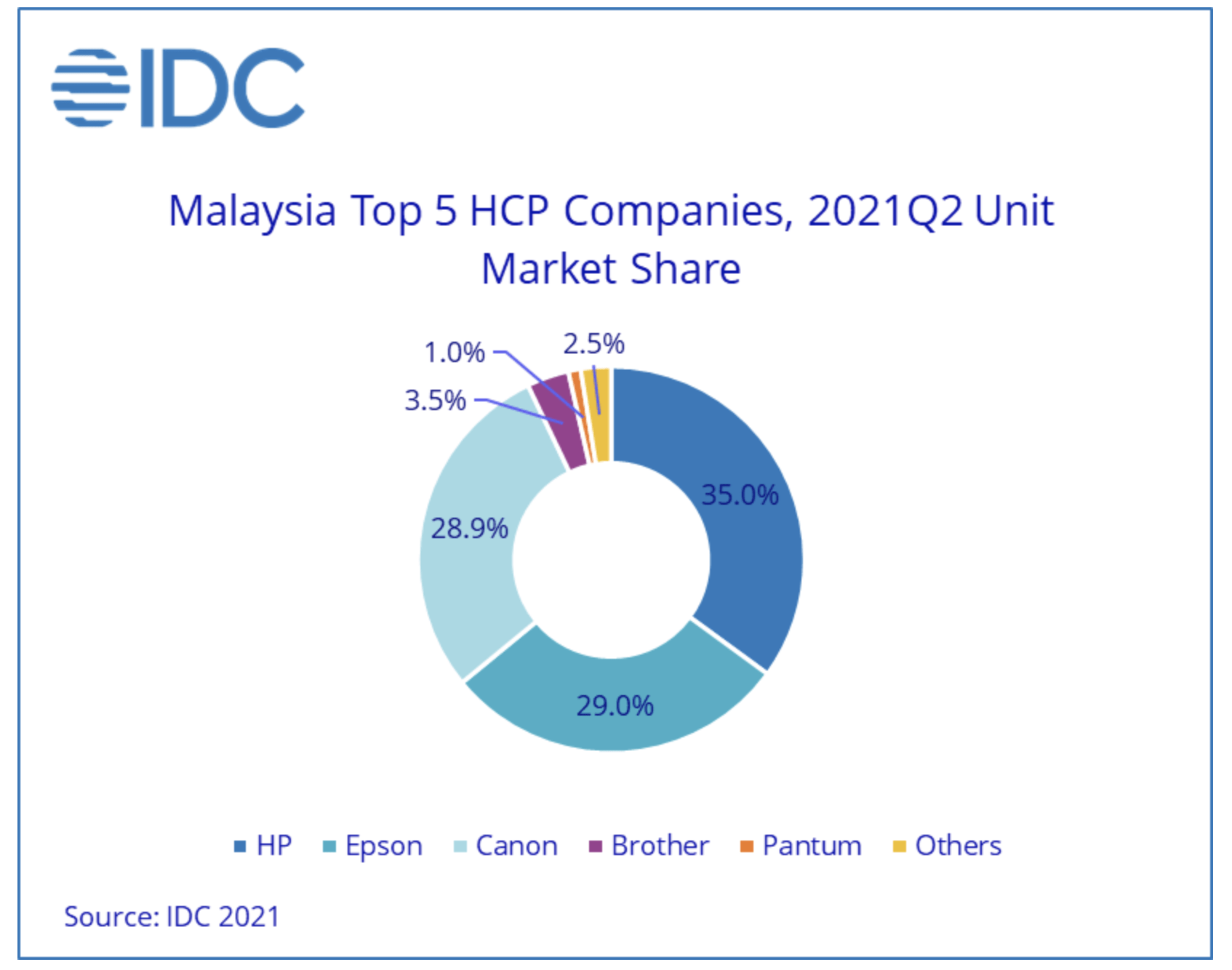

Top three home/office printer brand highlights:

HP managed to be the market leader in 2021Q2 with a market share of 35.0%, in comparison to the previous six quarters when HP was placed second. The main contributor to this improvement was their inkjet printers, especially the entry-level ink cartridge models which are more affordable. While there were not many projects win in 2021Q2 due to the stricter lockdown, HP managed to win a few project tenders at the beginning of the year for their laser printers and laser copiers.

Epson captured a market share of 29.0%, with a YoY growth of 171.2% in 2021Q2. Compared to previous years whereby Epson’s Ink Tank printers were mainly targeted at SOHO and SMB users, Epson witnessed a high demand from the home user segment. Shoppers would opt for ink tank printers due to higher page yield and lower total cost of ownership. Epson’s high YoY growth was also contributed by their serial dot matrix (SDM) printers. As there were production issues in the previous two quarters before 2021Q2, there were backorders to replenish channel partners’ inventories.

Canon captured a market share of 28.9%. Although placed in third position, Canon was the market leader for the past six quarters before 2021Q2. The decline in 2021Q2 was mainly due to inkjet printers which contribute the most to their shipments as COVID-19 had impacted printer production in terms of SOP adherence as well as COVID-19 clusters delaying manufacturing processes. Nevertheless, demand for Canon inkjet printers remained high from home-based users.

“For the remaining of 2021, we are expecting the demand for home printers to sustain as Malaysia’s daily COVID-19 cases remains high. With Government ramping up vaccination rate and opening the economy for fully vaccinated individuals, consumer and business sentiments are expected to improve,” said Sher Maine Cheam, Associate Market Analyst at IDC Malaysia.

“As there are still some supply chain issues and production delays, shipments are expected to be lower than the market demand over the next few quarters. Consumer demand is expected to sustain a bit longer due to work from home and remote learning. Commercial segment is expected to show a recovery over next one year, driven by pending/delayed projects and recovery in the SMB market,” ended Mohit Raizada, Senior Research Manager at IDC Asia Pacific.