Announcing their Q3 results Xerox said it would raise 2019 guidance for earnings per share (EPS) and cash flow.

Announcing their Q3 results Xerox said it would raise 2019 guidance for earnings per share (EPS) and cash flow.

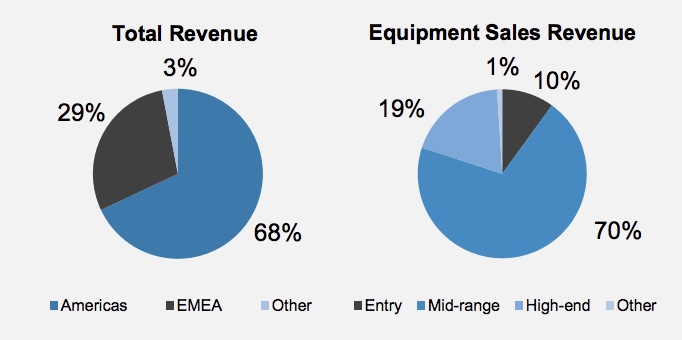

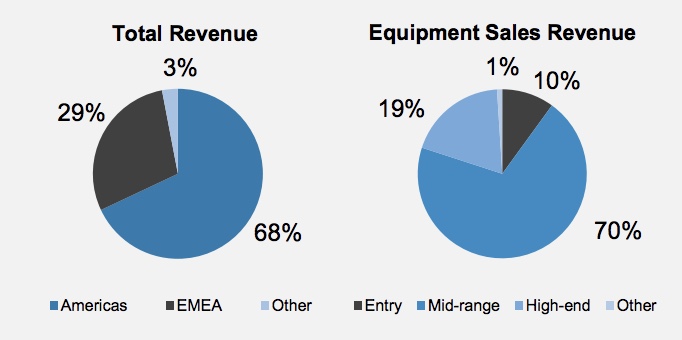

In Q3, Xerox posted a $2.2 billion (€1.98 billion) of revenue, a decrease of 6.5 percent in actual currency, or 5.3 percent in constant currency, year-over-year. Profit margins improved from previous quarters and Xerox stated that it was on track to drive 2019 gross savings of at least $640 million (€578 million) under Project Own It, Xerox’s enterprise wide initiative to simplify operations, drive continuous improvement and free up capital to reinvest in the business.

“Our strategy and execution delivered a strong third quarter despite industry headwinds. We increased cash flow, earnings per share and adjusted operating margin while we improved the revenue trend. These results give us confidence to raise our earnings and cash flow guidance for the year as we position Xerox for long-term growth,” said Xerox Vice Chairman and CEO John Visentin.

Equipment sales were down 3.3 percent year-on-year to $0.5 billion (€0.45 billion), post sales are down 7.3 percent year-on-year to $1.7 billion (€1.53 billion) and Xerox Services revenue was down six percent year-on-year.

Entry level A4 MFPs colour devices sales were up ten percent whereas black and white devices were down 6 percent. In the mid-range sector, colour devices were up two percent and black and white down by 20 percent. In the high-end sector colour devices were up 12 percent and black and white devices were down 22 percent.

Xerox also said that it added and renewed several contracts with Fortune 500 and public sector clients such as AstraZeneca, Leonardo S.p.A., Cardiff Council, and Prince George’s County Public Schools during the third quarter, launched new products and enhancements such as the Xerox PrimeLink C9065/C9070 and the iGen 5 XLS.

Xerox also announced today that it has completed its evaluation of its customer financing business and will not pursue a sale of the business at this time. The company received and reviewed bids from multiple potential counterparties that were interested in purchasing the business at an attractive premium but ultimately determined that retaining and optimizing the business through Project Own It will generate the greatest return for shareholders.

In its 2019 full year financials expectations Xerox adjusted revenues will be overall down by about six percent.

Editor’s Opinion: All of the OEMs are playing catch up and change to keep pace with market trends where print, while essential in every aspect of life, is no longer cutting edge. Xerox, like all the other OEMs needs a better offering for the long term, or one or more of these brands might be around in five years.