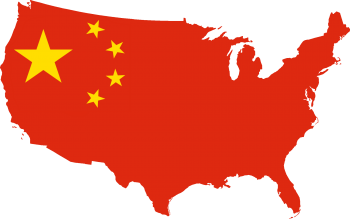

A 90-day truce was agreed upon this weekend by Presidents Trump and Jinping; but despite this seemingly positive development, experts remain sceptical about the resolution of the conflict between these two economic powers.

As CNBC reports, though markets experienced an upturn following the agreement of the ceasefire, experts have “repeatedly expressed doubt” that the 90 days will result in any real progress regarding the resolution of the dispute.

“This is not a truce, this is not an armistice,” said Steve Okun, senior advisor at McLarty Associates, adding, “Sure, it’s a good sign that presidents talk, it’s a good sign that they’ve set some kind of 90-day period — even though we don’t really know what’s expected to occur in that 90 days — but the trade war is on.”

The 90-day truce was agreed on by the presidents during the G-20 summit held in Argentina over the weekend, where Trump agreed “to not raise tariffs on $200 billion (€) worth of Chinese imports from 10 percent to 25 percent in January as he had previously threatened”.

However, if no resolution to the trade war is reached during this time, those tariffs will be reinstated.

News of the truce led to a spike in Asian stocks today, as well as a rise in US stock futures and in oil prices. But experts are remaining reticent about the likelihood of any concrete conclusion to the conflict, with economics professor Antonio Fatas noting that the ceasefire was merely a “continuity of the trade policy that the Trump administration has had”. He added that “it makes sense for the markets to be positive on this development because things look better than a week ago. But there’s no sense of direction, it’s not clear what battle we’re fighting here…it’s very hard to see the endgame when you don’t know what the strategy is here”.

Dutch bank ING is being similarly sceptical, stating, “90 days to work out a broad agreement is very short. Especially because the agreement should also encompass a deal on more sensitive issues like the theft of intellectual property and forced technology transfers in joint ventures. Most wide-ranging bilateral trade agreements take years to negotiate.”

Political risk consultancy, Eurasia Group, has also warned that “Trump could lose his enthusiasm for a deal if he encounters criticism domestically for a weak agreement, if his fears over a US market downturn fade, and once the theatre of his meeting with Xi is over”.

Even if the two superpowers do find some means of resolving the war during the 90-day ceasefire, “there’s no guarantee that tensions would ease”, according to Taimur Baig, who works as Chief Economist and Managing Director at DBS, a bank in Singapore.

“There has been some middle ground found between the U.S. and the Canadians and the Mexicans. Where has that led to? We still got a whole bunch of tariffs on steel and other products … that hasn’t gone away just because a new deal has been signed,” he explained.

“So, the idea that a process or some sort of a resolution would mean significant easing of tariffs or significant easing of restrictions that already have been imposed? I don’t think so,” he added.