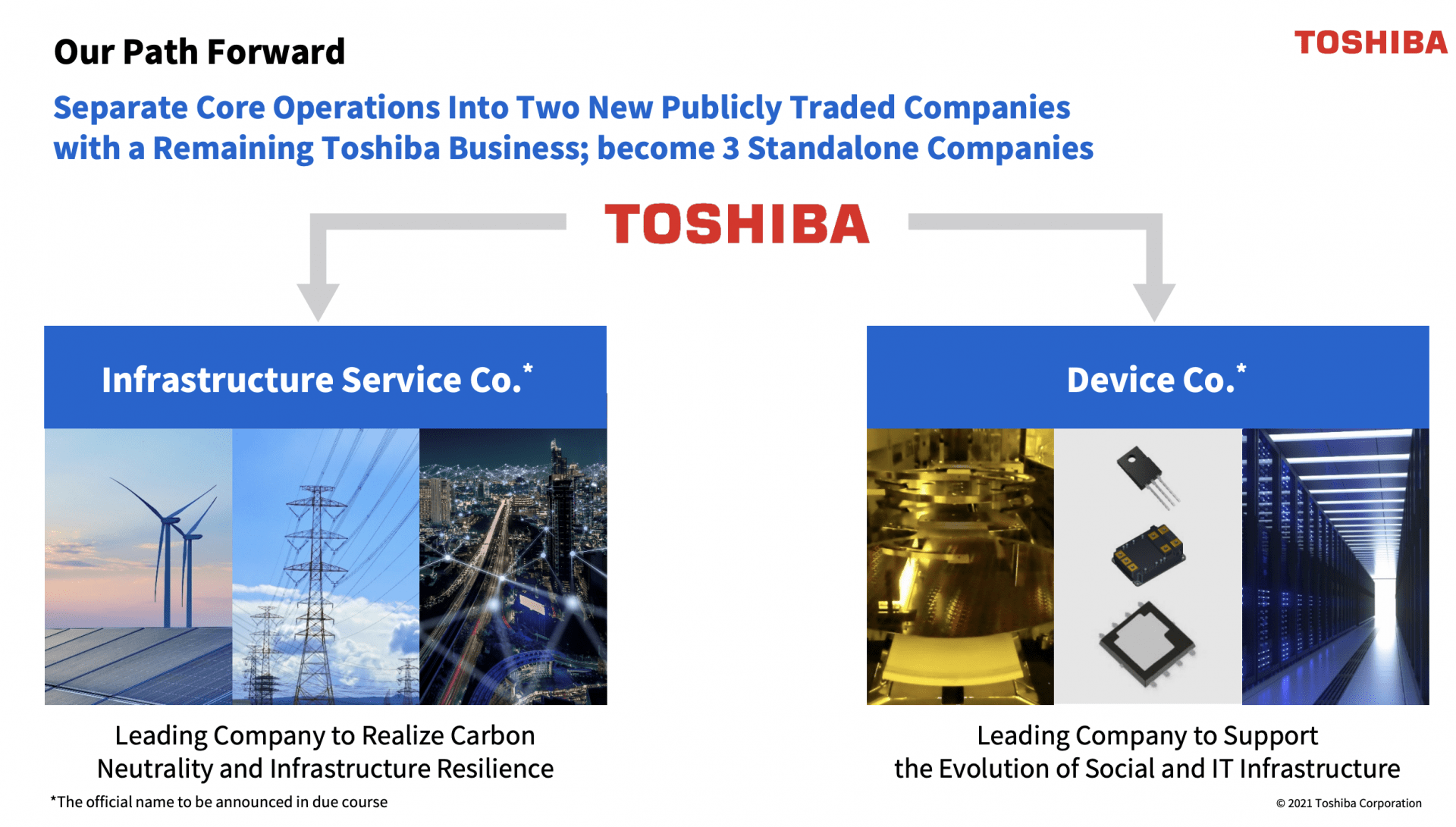

The company’s refined plan includes a tax-free spin-off of Device Co., resulting in two distinct companies with what Toshiba calls “agile management and leaner cost structures”.

Toshiba Corporation, as part of its Toshiba IR Day, provided an update on its 12 November 2021 strategic reorganisation announcement. Toshiba announced its intention to separate the Company into two standalone companies, instead of three, as previously announced:

- Toshiba/ Infrastructure Service Co., comprising Toshiba’s Energy Systems & Solutions, Infrastructure Systems & Solutions, Digital Solutions and Battery businesses, in addition to Toshiba’s ownership stake in Kioxia Holdings Corporation (“KHC”); and

- Device Co., consisting of Toshiba’s Electronic Devices & Storage Solutions business.

The decision to separate into two independent, publicly traded companies is the result of the Toshiba Board of Directors’ continued review of the strategic reorganisation plan and process, as well as the Company’s extensive engagement with shareholders, regulators and other stakeholders. Toshiba determined that the fastest, most effective and efficient way to deliver sustainable profitable growth, enhanced shareholder value and compelling benefits to customers, business partners and employees is to proceed with the separation into two standalone companies.

Satoshi Tsunakawa, Interim Chairperson, President and Chief Executive Officer of Toshiba, said: “After further engaging with key stakeholders and completing the additional analysis, we determined that separating Toshiba into two standalone companies and divesting certain non-core assets is in the best long-term interests of our company and its shareholders, customers, business partners and employees. The refined strategic reorganisation plan creates two distinctive companies that are well-positioned to take advantage of their unique strengths and business cycles. We will be able to deliver these benefits while providing a clearer path to completion, reducing the associated costs, maintaining tax-free status and keeping to our stated timeframe of completing the spin-off in the second half of FY2023.”

Paul J. Brough, Independent Director, Chairperson of Toshiba’s Strategic Review Committee, said: “Stakeholder feedback is an important part of any strategic process. The refinement of the separation plan reflects the open and robust conversations we have had with shareholders and other relevant parties. As the Board and management team move forward with the separation plan, we remain focused on enhancing shareholder value, including returning excess capital to shareholders and externalisation of non-core businesses to streamline and focus our two standalone companies.”

Overview of the Two Companies

Toshiba/ Infrastructure Service Co.

Infrastructure Service Co. will consist of Toshiba’s Energy Systems & Solutions, Infrastructure Systems & Solutions, Digital Solutions and Battery businesses, in addition to Toshiba’s ownership stake in KHC. Its products and services will include power generation, transmission and distribution, renewable energy, energy management, systems solutions for public infrastructure, railways and industry, and IT solutions for government agencies and private companies. Its increased focus, combined with its innovative technological solutions, will enable it to play a leading role in driving the transition to renewable energy to meet ambitious global carbon neutrality goals and advancing infrastructure resilience.

Toshiba/ Infrastructure Service Co. is expected to have net sales of ¥1.52 trillion ($13.22 billion/ €11.55 billion) in FY2021 and is projected to grow at a compound annual growth rate (“CAGR”) of 5.3%, reaching ¥1.87 trillion ($16.26 billion/ €14.21 billion) by FY2025. It also expects to improve operating income margins from 3.6% to 6.4% over the same period.

While maximising shareholder’s value, Toshiba said it will immediately monetise its shares in KHC to the extent which is practically possible to conduct, and will return the net proceeds in full to shareholders, within the limits stipulated by applicable laws and regulations. The Company plans to put forward a shareholder resolution outlining its plans for its KHC holdings at the upcoming extraordinary general meeting of shareholders (“EGM”), which will take place in March 2022.

Device Co.

Device Co.’s structure remains unchanged from the announcement on 12 November 2021. It will comprise Toshiba’s Electronic Devices & Storage Solutions business. Its products will include power semiconductors (silicon, compounds), optical semiconductors, analogue integrated circuits, high-capacity hard disk drives (“HDD”) for data centres (nearline HDDs) and semiconductor manufacturing equipment. It will be a leader in supporting the evolution of social and IT infrastructure.

Device Co. is expected to have ¥860 billion ($7.48 billion/ €6.54 billion) in net sales in FY2021 and is projected – when excluding the memory resale portion – to grow at a CAGR of 4.1%, reaching ¥1.01 trillion ($9.6 billion/ €8.4 billion) by FY2025. It expects operating income margins to improve from 6.4% in FY2021 to 7.9% by FY2025.

Device Co. will be spun-off from Toshiba and company stock of Device Co. will be distributed to Toshiba’s shareholders at the time of the spin-off record date. Toshiba is working with relevant authorities and advisors to determine the best and the most effective and efficient way to spin-off the business with an intention of effecting the transaction in a tax-qualified spin-off structure via the recent tax reform legislation in Japan.

The reorganisation remains on track to be completed in the second half of fiscal year 2023, subject to the completion of necessary procedures, including the approval from Toshiba’s general shareholder meeting and fulfilment of all review requirements from relevant authorities, the company said. The financial results of Device Co. must be audited for a two-year period, beginning with FY2021 results, before the spin-offs can be completed.

As part of the strategic reorganisation process, Toshiba separately announced that it has entered into an agreement to sell its joint venture stake in Toshiba Carrier Corporation to the Carrier Group for approximately ¥100 billion ($870 million/ €760 million). The Company is also moving forward with divestiture plans for Toshiba Elevator and Building Systems Corporation and Toshiba Lighting & Technology Corporation. In developing its strategic plan, Toshiba has designated Toshiba Tec Corporation as a non-core business. Toshiba will work with Toshiba Tec in the short-term, to the extent practical, to facilitate Toshiba Tec’s own mid- to long-term business plan following this designation.

As Toshiba announced in November 2021, any capital in excess of the appropriate level of capital will be used to fund shareholder returns, including share repurchases in FY2022 and FY2023, to the extent that it would not interfere with the smooth execution of the business separation.

After reviewing the updated capital requirements to support Toshiba’s growth plans, it is expected that the capital will exceed the appropriate capital level by approximately ¥300 billion ($2.61 billion/ €2.28 billion) in the next two years, assuming the smooth execution of the business plan disclosed today. The company said that this excess capital will be used for shareholder returns to the extent that it does not interfere with the smooth execution of the spin-off.