Inkjet MFP shipments continue to decline, except segment 2 and 3 CISS MFPs according to the latest reports by Virtulytix.

Inkjet MFP shipments continue to decline, except segment 2 and 3 CISS MFPs according to the latest reports by Virtulytix.

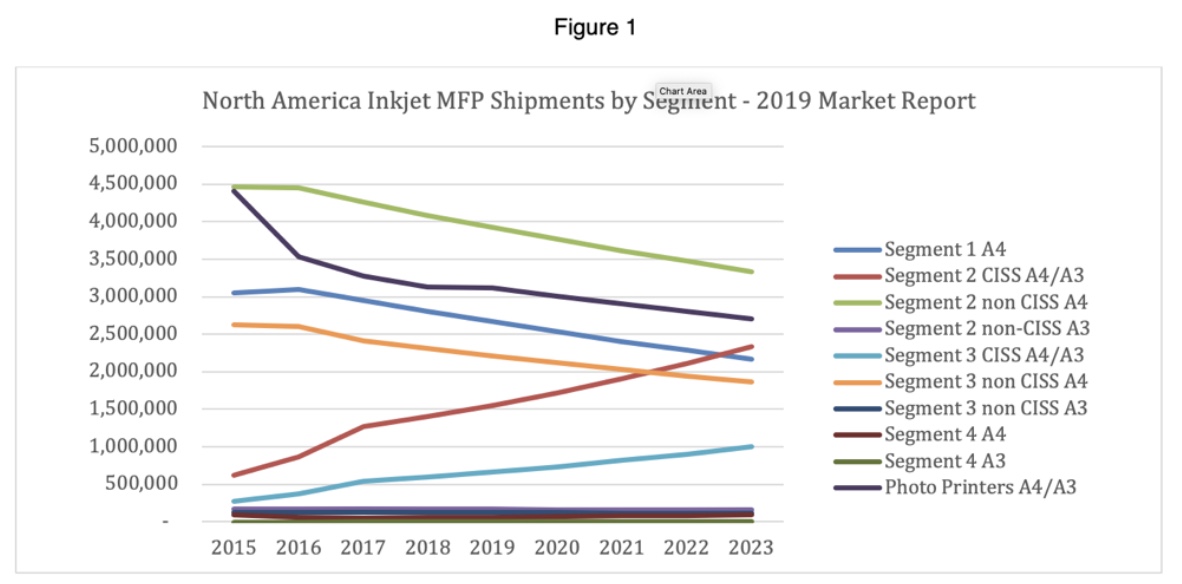

Recently released Global Market reports from Virtulytix indicate that while inkjet MFPs are continuing their decline, segment 2 and 3 CISS (continuous ink supply system) MFPs are showing strong growth (see Figure 1). These findings are covered in the Virtulytix Office Printer and Supplies Market report series for hardware (laser and inkjet), supplies (ink and toner), and media (paper and specialty media).

The new market reports include actual printer hardware and consumables shipments, installed base, average sales prices and revenue from 2015 – 2018 and forecasts from 2019-2023. According to Ron Iversen, Vice President of Market Intelligence at Virtulytix, these new reports are the most comprehensive analysis of the office printer supplies (ink, toner, media) industry available today.

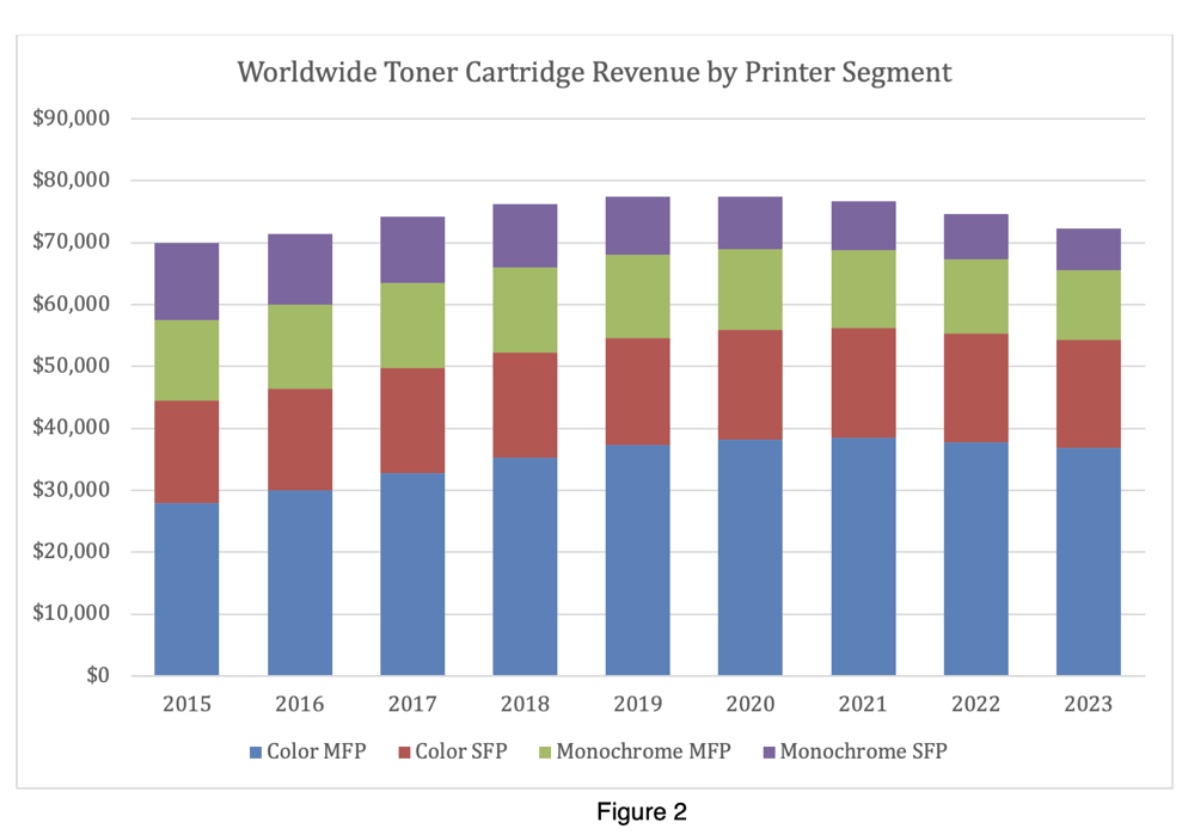

The supplies reports are critical since office printer supplies represent about 70-80% of total worldwide office printing revenue (60% ink and toner, 20% media), with printer hardware accounting for the remaining 20%.

Virtulytix explains that the full worldwide excel pivot table based forecasts allow clients to generate custom cuts of the forecasts by printer type (lasers, inkjets), by printer segment (speed, MFP vs. SFP, mono vs. colour, by cartridge type (mono, colour, tri-colour, OEM vs. Aftermarket), by geography, and by type of media type (Media Forecast). The 2019 Inkjet Printer Hardware and Supplies Forecasts and Forecast Perspectives include special segments for CISS devices (Continuous Ink Supply Systems), high speed inkjet printers and supplies (HP PageWide class devices), and for photo printers.

Virtulytix explains that the full worldwide excel pivot table based forecasts allow clients to generate custom cuts of the forecasts by printer type (lasers, inkjets), by printer segment (speed, MFP vs. SFP, mono vs. colour, by cartridge type (mono, colour, tri-colour, OEM vs. Aftermarket), by geography, and by type of media type (Media Forecast). The 2019 Inkjet Printer Hardware and Supplies Forecasts and Forecast Perspectives include special segments for CISS devices (Continuous Ink Supply Systems), high speed inkjet printers and supplies (HP PageWide class devices), and for photo printers.

The 2019 Cartridge Forecast Perspectives include many informative charts such as Figure 2 from the Global Toner Cartridge Forecast Perspective which highlights the recent growth in Colour MFP supplies, and the projected declines in total toner supplies in the future.